- This topic has 11 replies, 8 voices, and was last updated 6 years ago by slowster.

-

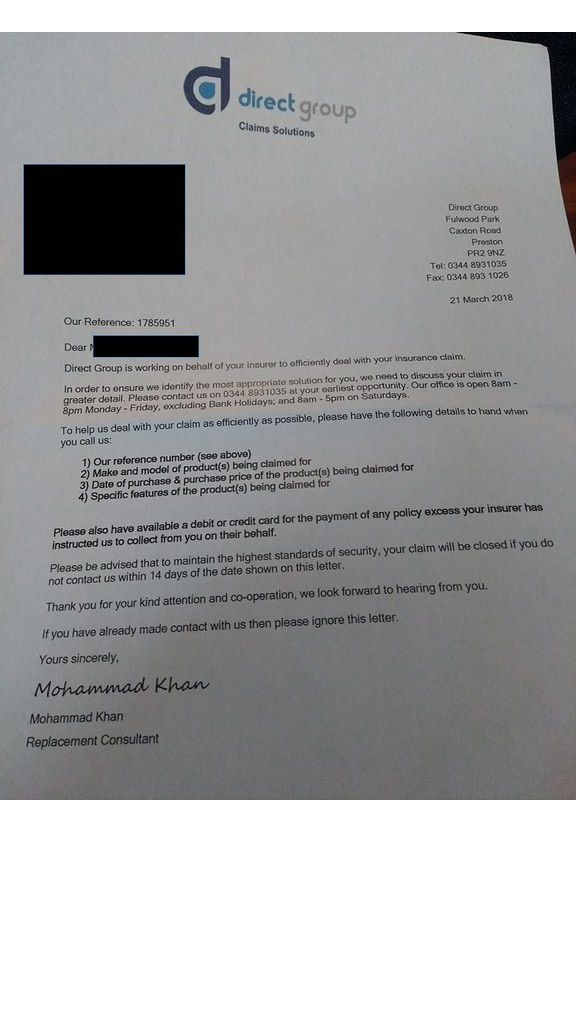

Dodgy insurance scam?

-

kimbersFull MemberPosted 6 years ago

car (& bike 🙁 ) stolen last week

this arrived today with wifes name on it (car insurance is in her name, house in mine so theyve got info via insurer?)

thehustlerFree MemberPosted 6 years agoAlot of insurance companies work via a ‘claims handler’ now, you can or cant use them, your choice.

legendFree MemberPosted 6 years agoJust phone the insurer, they’ll tell you in seconds if it’s real or not

kimbersFull MemberPosted 6 years ago<div>Unless its possibly from the people that stole our car & my wifes handbag as her driving license was in there & it has her name & address on it?</div>

<div></div>

<div>fwd to police dealing with theft & national fishing police</div>drnoshFree MemberPosted 6 years agoYet another feckking example of data being ‘shared’ all round the internet.

Facebook and Cambridge Analytica being just the tip of the iceberg.

slowsterFree MemberPosted 6 years agoLooks quite genuine to me judging by the website http://www.directgroup.co.uk/. The telephone number in your letter is the one they publicise on the contact page of their website for customers of Direct Line.

With regard to the comment about having credit card details ready for any excess payment, it is a standard generic letter and I presume that it would not apply in your case because the claim will be settled by them making you a cash offer on behalf of your insurer, which would be paid to your wife net of the excess.

My main concern in your shoes would be not to allow communications over the phone to result in a rushed decision about accepting any offer. I would hope that the initial call would be just for them to get enough information about the car etc. to be able to make a decision about an offer and put it to you in writing.

Edit – cross posted with your post stating that it’s a scam. I am surprised given information about them on the internet, not just their own website, e.g. this insurance press article.

rachelgreepFree MemberPosted 6 years agoWe had similar recently when we made a claim.

We phone our insurance company and they confirmed it was a fake. How they think they can get away with it, with a paper trail is beyond me.

kimbersFull MemberPosted 6 years agohmmmm , it does look like the legit number for direct group

its definitely not our car insurance people as theyve confirmed its nothing to do with them

Direct group are listed as A provider for our home insurance company, but not THE provider on our policy document, the home insurance is also listed in my name, not my wifes (who this letter was addressed to)

We were told by our home insurers wed be dealing with Ageas only from now on, (but they are closed till monday)

sillysillyFree MemberPosted 6 years agoWouldn’t surprise me if there has been a data breach at insurance co, DVLA or some intermediary / sales affiliate. Had a similar letter recently with what looks to be insurance / DVLA data where someone was trying to take insurance in my name. Flagged with this org to try and stop it happening in future: https://www.cifas.org.uk/

deadkennyFree MemberPosted 6 years agoThey’re not necessarily considered scams in the illegal sense, but just claims companies after business and possibly engaged by some insurance companies to try to hoover up money. Have had one through years later from a claims company after insurance claim that was long since dealt with and paid up, asking for all kinds of details. Ignored. Never heard from again.

Car crashes/accidents and thefts they can pick up data from reports most likely. DVLA / police, or insurers share this out? Don’t know. Small bump I had once and had a whole bunch of injury claim texts shortly after for a while. Though I get speculative ones anyway but those were many focused around the time of the incident.

This one though, the red flags are that they don’t know/state what you’re actually claiming for and are asking for those details, and that they want you to have a credit card on hand. Big no there.

And yes, companies can seem very legitimate with good write ups, big name clients. See Cambridge Analytica 😉

slowsterFree MemberPosted 6 years agoDirect group are listed as A provider for our home insurance company, but not THE provider on our policy document

Your policy document will make reference to the name of your insurer. If it is a policy issued by an organisation that is not an insurer, e.g. a building society, a bank, Saga, John Lewis etc., then the policy will still state the name of the insurer that is underwriting it. The policy might list the names and contact details of one or more claim management companies to contact in the event of a claim (more than one, because there might be different possible types of claim which would determine which claims management company should be contacted depending upon their specialism, e.g. property damage, legal expenses, travel etc.).

An insurer might however prefer not to print the name and contact details of any claims management compay it uses in a policy document, not least because it could change providers part way through your insurance cover.

This one though, the red flags are that they don’t know/state what you’re actually claiming for and are asking for those details,

Not necessarily. It’s consistant with being a standard form letter from a claims management company to which an insurance company has outsourced the management, negotiation and settlement of claims. It’s quite likely that the initial notification to the insurance company of the claim often does not include the sort of detail mentioned in the letter which is necessary to establish exactly what is the specification/model of the item being claimed for, and what would be appropriate to settle the claim (how much cash or what current model/specification if the insurer is to provide a replacement).

and that they want you to have a credit card on hand.

This would concern me too, but it could be entirely legitimate. As I say, if the claim is settled by cash/cheque or by providing a voucher to buy a bike from the likes of Wheelies, then the excess can simply be deducted from the amount of the cheque or voucher. However, there will be schemes where the insurer will offer an actual replacement for the damaged/destroyed/stolen item (obviously it will have suppliers for common large ticket items like white goods, TVs etc., and it will have negotiated large discounts from those suppliers) – in that scenario it would make sense that the insured would have to pay the excess. However, that should not be necessary until the negotiations were completed and there was agreement about how the claim was to be settled. Requesting actual payment of the excess at the beginning of negotiations, or credit card details in advance, does sound wrong, but it’s possible that some claims might be resolved in that first phone call, with an agreement to have one of their suppliers send a new TV or fridge etc. straightaway.

And yes, companies can seem very legitimate with good write ups, big name clients. See Cambridge Analytica

Pretty much anyone can set up a business and form a limited company. Insurance companies however have to be authorised by the Financial Conduct Authority, and the Direct Group is listed on the FCA Register.

The topic ‘Dodgy insurance scam?’ is closed to new replies.