- This topic has 62 replies, 26 voices, and was last updated 10 years ago by CaptainFlashheart.

-

Cooperative Bank – should I withdraw my money?

-

WoodyFree MemberPosted 10 years ago

Couldn’t find anything in ‘search’ so apologies if it’s already been done…..

For a change, I have some money in a basic savings account which will be used before the end of the year. Worth moving ?

StonerFree MemberPosted 10 years agoDeposits are protected so there’s no risk to you from the Chairman getting high on Meth 😉

But you see this is what happens when you leave hard-nosed financial decisions to a bunch of wet woolly liberals. They’d have done much better investing in BAT, Phillip Morris, News International and BAe rather than The Labour Party, Yoghurt Knitters Association and Sandals’R’Us.

😉

teamhurtmoreFree MemberPosted 10 years ago😀

I would base your decision on the returns your are getting from the Co-op and the need for access first. The safety of your deposits is probably ok and is guaranteed up to a level in the event of a failure. It wont be instant access in that case though.

wwaswasFull MemberPosted 10 years agoI can see someone withdrawing money in protest at the shambles their approach to management seems to be – I’ve considered moving my overdraft elsewhere – but the money itself is safe.

RustySpannerFull MemberPosted 10 years agoStoner – Member

Deposits are protected so there’s no risk to you from the Chairman getting high on Meth

But you see this is what happens when you leave hard-nosed financial decisions to a bunch of wet woolly liberals. They’d have done much better investing in BAT, Phillip Morris, News International and BAe rather than The Labour Party, Yoghurt Knitters Association and Sandals’R’Us.

Utter, utter bollocks I’m afraid.

I worked for them for years – their success was achieved when they were an ethical, genuinely Cooperative movement.

All the difficulties started when they abandoned their principle about 10 years ago and invited a bunch of shysters and speculators to take over.

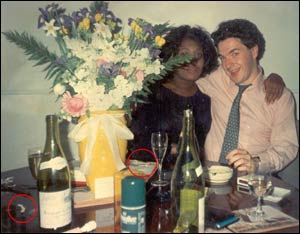

And they buggered it up just like they did the rest of our financial services industry.binnersFull MemberPosted 10 years agoWould you leave your car in a garage, for a full engine rebuild, having found out that the mechanic doing it wasn’t actually a mechanic at all? But to be fair to him he once worked next to a garage, 40 years ago. And he seems like a nice bloke. Puts some cracking parties on!

Oh… he’ll probably have 12 pints before he starts the job. And recently when asked by a bloke in charge of inspecting garages ‘how many wheels do most cars have?’, he thought the answer was 23

JunkyardFree MemberPosted 10 years agoamusing reply Stoner

My money is still there but we all know all bankers are **** the good ones are just slightly less ****ish 😉

StonerFree MemberPosted 10 years agoI like binners’ analogy even better.

Who’d have thunk it. The head of the Co-Op was the Toronto Mayor of UK banking?

There, there, Rusty. I can put some more smiley’s on my dig if it makes the pain go away…

Ro5eyFree MemberPosted 10 years agoMy money is still there but we all know all bankers are **** the good ones are just slightly less wankerish

Genuine question … Why then?

Why do you use a bank to keep your savings?

teamhurtmoreFree MemberPosted 10 years agoAnd they buggered it up just like they did the rest of our financial services industry

Which neatly falsifies the argument that bankers do bad things because they are only interest in their shareholders.

Bloody mess the coop. Perhaps if you pay a CEO about 10-20% of the salary of the CEO of most high street banks then your drive him to meths? Alternatively, as the saying goes, pay (relative in this case) peanuts…..

teamhurtmoreFree MemberPosted 10 years agoRo5ey – good point, risk aversion. Despite negative real interest rates money is flooding into short term Overnight deposits across Europe. Its one thing that is screwing up monetary analysis and monetary policy. Govs would love people to think like you and do other things with their money. But they are not doing it……

JunkyardFree MemberPosted 10 years agoWhy do you use a bank to keep your savings?

What do you want me to do buy gold bars or invest in fine arts?

Savings is a somewhat overestimation of my three figure [ not counting the pence] investment

wwaswasFull MemberPosted 10 years agoWhat do you want me to do buy gold bars or invest in fine arts?

Local Credit Union?

teamhurtmoreFree MemberPosted 10 years agoJY, there’s a nice painting coming up for sale soon in Edinburgh. Going for a song apparently!

Ro5eyFree MemberPosted 10 years agooverestimation of my three figure [ not counting the pence] investment

Right, so it is an investment.

You are trying to make more money from the money you have…. you are trying to make a profit.

I didnt think that was allowed

Oh …. and I’d defo not buy gold… art on the other hand

drlexFree MemberPosted 10 years agoBloody mess the coop. Perhaps if you pay a CEO about 10-20% of the salary of the CEO of most high street banks then your drive him to meths? Alternatively, as the saying goes, pay (relative in this case) peanuts…..

To be fair, the woes of the Co-op bank stem from their 2009 purchase of the Britannia B.S. citation – the opening of their glitzy HQ does seem to echo the last days of RBS.

RustySpannerFull MemberPosted 10 years agoStoner – Member

There, there, Rusty. I can put some more smiley’s on my dig if it makes the pain go away…

So it was just a joke?

Of course.MrWoppitFree MemberPosted 10 years agoBailed ages ago after the Britannia fiasco. Now with Halifax. £100 for joining, £5 a month for nothing. What’s not to like?

binnersFull MemberPosted 10 years agoThat sounds about as sustainable as a long term business plan as most of HBOS’s previous genius activities

Just remind me how that went again?

teamhurtmoreFree MemberPosted 10 years agoSome of Santanders accounts are great if used correctly. But then again “profits” go back to Spain don’t they and we can’t be having that!!!!

StonerFree MemberPosted 10 years agoTHM – I thought there was still a moratorium on the repatriation of any funds by Santander – incl profits

JunkyardFree MemberPosted 10 years agothere’s a nice painting coming up for sale soon in Edinburgh. Going for a song apparently!

Well played Sir 😀

You are trying to make more money from the money you have.

I have few quid in a co-op bank account. the account pays interest like every other bank account. I am not trying to make money from it – the interest payment is less than inflation so i am not doing it very well!

it is there as its safer than leaving it under my mattress

Is there a point here as I am not getting it tbh.binnersFull MemberPosted 10 years agoIsn’t it academic where the profits end up really? Its not like banks pay any of it in tax, is it? 😉

teamhurtmoreFree MemberPosted 10 years agoStoner, I am not aware of the moratorium. But again, I was being flippant in my break!!!

richmtbFull MemberPosted 10 years agoThat sounds about as sustainable as a long term business plan as most of HBOS’s previous genius activities

Just remind me how that went again?

In 2007 I had a Halifax savings account that paid 10% interest,

Its not hard to see where it all went wrong to be honest

mosFull MemberPosted 10 years agoFWIW we have approx £1.5M of business banking with them at the moment, which doesn’t appear to be covered because of our turnover. So we are taking most of it out.

helsFree MemberPosted 10 years agoWell, you would be contributing to a self-fullfilling prophecy. If everyone took their money out tomorrow, it may cause problems for more than just the Co-op.

vorlichFree MemberPosted 10 years agoWe do all our banking with Co-op. I did look a while back at other ‘ethical’ options, but there doesn’t seem to be much competition TBH.

We’re saving for a house deposit ATM, I’m not concerned about the security of the cash. But I am dismayed with the current state of affairs.

A real shame as the service from Co-op has always been first class.

cranberryFree MemberPosted 10 years agoAt least we now have an answer to the question “What sort of drugs do you need to be on to think that Ed Balls would be a good chancellor?”.

MrWoppitFree MemberPosted 10 years agobinners – Member

That sounds about as sustainable as a long term business plan as most of HBOS’s previous genius activities

What does?

kimbersFull MemberPosted 10 years agoIts funny that this seems to be an issue when our coke n hookers loving chancellor can do no wrong?

teamhurtmoreFree MemberPosted 10 years agoIs not what you know Kimbers, it’s who you know (Andy C?). Did you not know that?!?!

WoodyFree MemberPosted 10 years agoA real shame as the service from Co-op has always been first class.

Agreed, and with the exeption of a heated phone conversation with an odious turd in their credit card dept. (he lost), I have had nothing but good service. I also have my mortgage and building/contents insurance with them.

It’s very annoying, if that’s the right word, that the only bank which at least tried to be ethical in the past, has come to this 👿

StonerFree MemberPosted 10 years agoGuido Fawkes’ new House of Commons gallery correspondent has a great style:

Considering the aggregate of recent events Stephen Brine enjoyed quite a range of options with which to open the Government batting at PMQs. He said: “The nightmare of my disbelief at the Opposition Leader’s gay-porn male prostitute front bench million pounds for hard working mums and dads against Ed Miliband’s Welfare party on amphetamines?”

The Prime Minister agreed that there were questions for Labour to answer, about who knew what when, why, whither and who in the Labour party had put the meth in Methodist.

“Edward Miliband!” the Speaker called in such an impartial way that a stress fracture broke out in his forehead.

Ed Miliband rose to speak for the children of Chipping Norton. They were having their Children’s Centre closed. “Children’s lives are being destroyed by the Conservative cost of living crisis,” he said. “Heartbreak soldiers pride in British children with a fair wage, without VAT tax evading fraudsters pouring money into the Conservative party because their leader is a LOSER!”

The Prime Minister handled it with ease and some asperity. “What he doesn’t say, because he’s pathetic, is that now there’ll be one fewer set of school gates where Labour donors can peddle crack cocaine!”

That played into Ed Miliband’s line of attack: “I think we have established that the out of touch Prime Minister just doesn’t understand that the price of crack cocaine now puts it totally beyond the reach of squeezed children who are being forced into coke banks by pay day Tories!”

George Osborne heckled: “Shove it up your forearm with a turkey baster, you sick, bent, rent boys!”

Visibly deflated, the Opposition leader concluded his attack with, “What he has shown today is that he has no answers!”

“I may not have answers,” the Prime Minister laughed, “but you don’t have any questions.”

“Touché,” all sides cried and repaired behind the Speaker’s Chair where the crack pipes are kept.

Note. Reconstruction. Dialogue may not represent actual dialogue. Steve Coogan appeared as David Cameron and Johnny Vegas as Ed Balls. Ed Miliband was played by himself.

dashedFree MemberPosted 10 years agoSo what happens to my Coop mortgage if there’s a Northern Rock type run on the Coop and it all goes to ratshit? Theoretically speaking like, not that I’m particularly concerned about it happening, cos if they did go down the pan then my mortgage would be written off and I’d own my home outright, wouldn’t I!!??? 😉

The topic ‘Cooperative Bank – should I withdraw my money?’ is closed to new replies.