- This topic has 139 replies, 54 voices, and was last updated 7 years ago by trail_rat.

-

'Boom' here we go (bubble burst content)

-

EdukatorFree MemberPosted 7 years ago

68% of Brits own their own home

Of whom how many are really renting their house from their bank while assuming all of the downside risk in the hope of some upside?

I’d be very interested to know what percentage of that 68% is borrowed money.

doris5000Full MemberPosted 7 years ago68% of Brits own their own home, so falling house prices are very far from a good thing. The negative impacts on the broader economy far outweigh the “positives” for those looking to buy/upgrade.

as at 2013/14 this was down to 63% and falling. And the majority of owned them outright, having paid off a mortgage – so it makes little odds to them either way.

So only 30ish% of households are at any risk of negative equity, and I’d venture that most of those are well into their mortgage anyway.

EDIT –

for Edukator, above – a couple of articles from those stats:

http://www.theguardian.com/money/2015/feb/25/owners-outstrip-mortgage-holders

NorthwindFull MemberPosted 7 years agojambalaya – Member

Central London prices have been falling since the big hike in stamp duty

Or, not, average price up 3.4% last year, according to the FT. The rate of growth has fallen.

agent007Free MemberPosted 7 years ago68% of Brits own their own home, so falling house prices are very far from a good thing. The negative impacts on the broader economy far outweigh the “positives” for those looking to buy/upgrade.

Falling house prices are a good thing generally. The banks should be sufficiently capitalised and stress tested now to weather this storm. Lower house pieces = less debt required, more spare money in the economy generally to invest in roads, exporting businesses, NHS, schools etc, etc. Lower prices allow the young to rent, buy at a cost that doesn’t cripple them. If you’re looking to upsize then the gap between your place and a bigger place is less steep. Plenty more up sides too.

If you’ve mortgaged yourself up to the hilt and overstretched yourself financially to buy and as a result are in danger of being in negative equity, then really it’s your problem, no one else’s. No one forced you to borrow that money, and the fact you borrowed so much has just contributed to pushing prices up generally for the rest of us.

jonm81Full MemberPosted 7 years agoIf you’ve mortgaged yourself up to the hilt and overstretched yourself financially to buy and as a result are in danger of being in negative equity, then really it’s your problem, no one else’s. No one forced you to borrow that money, and the fact you borrowed so much has just contributed to pushing prices up generally for the rest of us.

Being in negative equity has no bearing on whether you have overstretched yourself or not. We have recently bought a house well within our means but if the price dramatically crashed then we would be in negative equity and therefore would not be able to recover the deposit from the house sale if we then want to move on.

As such you would end up with people who want to move up into bigger houses not being able to thus not relinquishing the starter home to those first time buyers you think should have a right to buy them.

ahwilesFree MemberPosted 7 years agojonm81 – Member

…you would end up with people who… etc.not many people, and only for a few years while they paid off the equity…

or, who are all these people who buy with high LTV, and then wish to move to a different house more or less immediately?

doris5000Full MemberPosted 7 years agoBeing in negative equity has no bearing on whether you have overstretched yourself or not. We have recently bought a house well within our means but if the price dramatically crashed then we would be in negative equity and therefore would not be able to recover the deposit from the house sale if we then want to move on.

As such you would end up with people who want to move up into bigger houses not being able to thus not relinquishing the starter home to those first time buyers you think should have a right to buy them.

i’m not sure this is as serious as people make out. Taking some generic figures –

a FTBer who bought a 200K house with a 10% deposit and 90% mortgage.

After 5 years, they’ll owe about 152K on the mortgage. So even with a market collapse of 25%, they’re basically in the clear, although obviously it’s not a desirable scenario.

So the only people at serious risk are those who have only just bought, at high LTVs, and really desperately have to move almost immediately. Unless i’m missing something?

molgripsFree MemberPosted 7 years agoWell, that’s assuming 25 year mortgage and some fairly low interest by the look of it…? And that’s the simple case.

25% drop isn’t that much if it’s new houses. We bought a house advertised at nominally £250k in mid 2007, we paid £237k and got a free deposit and some stuff (now you might say it wasn’t free, and you’d probably be right) but it allowed us to get on the ladder without having to save up a massive sum of cash*.

We adjusted our mortgage a bit for various reasons, so we didn’t pay as much capital as we’d have liked. Loads of the houses in our street were bought BTL, and when the crash came they were repossessed. So loads of them went for £160k, that’s a 36% drop. They were undervalued, clearly, and mine was overvalued, but that’s how it happened. Only now are we in a position where we might be able to move. So we were locked in for 8-9 years.

* reckless – maybe. But it got us on the ladder. I didn’t know the crash was around the corner…. And we had no savings so had we not been able to save up the deposit whilst prices were low and required LTVs were high we might’ve missed that boat, and we’d still be renting now in a crazy market. It’s complex.

doris5000Full MemberPosted 7 years agoWell, that’s assuming 25 year mortgage and some fairly low interest by the look of it…? And that’s the simple case.

It assumes a 2.5% interest rate. But there are plenty of cheaper mortgages than that around, even with a 10% deposit.

jonm81Full MemberPosted 7 years agoa FTBer who bought a 200K house with a 10% deposit and 90% mortgage.

After 5 years, they’ll owe about 152K on the mortgage. So even with a market collapse of 25%, they’re basically in the clear, although obviously it’s not a desirable scenario.

That is some pretty optimistic calculation. As a FTB with a 90% mortgage we borrowed 159k and when we sold 2 years later we still owed 152k. The best interest rate we could find was 6% over BoE base rate so a total of 6.5% and this is what most of our monthly payments were covering not paying off the loan. So if the house price had dropped by 25% we would have been stuck there for a long time. It happened to lots of people last time the market crashed and would happen again if it crashes this time.

In your scenario the owner would be in the clear but would it leave them with a deposit to buy somewhere else or would it leave them with just enough left over to pay off the remaining mortgage and force them back into the rental market?

molgripsFree MemberPosted 7 years agoIt assumes a 2.5% interest rate. But there are plenty of cheaper mortgages than that around, even with a 10% deposit.

NOW there are yes, but late 2007 there wasn’t!

thisisnotaspoonFree MemberPosted 7 years agoNo one forced you to borrow that money, and the fact you borrowed so much has just contributed to pushing prices up generally for the rest of us.

Ok then, what credible advice would you give to a 20something now looking to buy their first house? Not buy one?

Houses are arguably affordable, because people are living in them and paying for them, that they’re affordable for those at the bottom isn’t the fault of those buying houses to live in is it? It’s supply and demand, if there’s only enough houses for a fraction of the people that want to live somewhere, then house prices will reflect that. The population of Reading would probably quite like a nice farm house or barn conversion in the Chilterns, but you’d be looking at £1.2million+.

The problem is not a affordability for those that can afford it, it’s a lack of supply.

mrhoppyFull MemberPosted 7 years agoSo even with a market collapse of 25%, they’re basically in the clear

Ignoring the fairly optimistic rates you’ve got, they’re not in the clear, they’ve lost £20k if their deposit and now can’t move. So given that this house price shrinkage is probably going to be driven through some economic decline, people who need to move for jobs, or sell because they’ve been made redundant are screwed. And that’s before you consider the costs associated with selling/moving as well.

doris5000Full MemberPosted 7 years agoNOW there are yes, but late 2007 there wasn’t!

yes but we’re talking about now! 😆

this is where interest rates have been for years, so it makes sense (to me anyway) to use this as a starting point for discussion.

my parents were paying 17% at one point and it nearly killed them, but that’s not massively useful to the debate now 🙂

doris5000Full MemberPosted 7 years agoIgnoring the fairly optimistic rates you’ve got, they’re not in the clear, they’ve lost £20k if their deposit and now can’t move. So given that this house price shrinkage is probably going to be driven through some economic decline, people who need to move for jobs, or sell because they’ve been made redundant are screwed. And that’s before you consider the costs associated with selling/moving as well

apologies, when i said ‘in the clear’ what i meant to say was ‘not in negative equity’

teamhurtmoreFree MemberPosted 7 years agoThe problem is not a affordability for those that can afford it, it’s a lack of supply.

Not entirely. Houses range from v expensive to averagely expensive across the UK in relation to earnings but average to relatively inexpensive in relation to interest cost. This reflects the current unorthodox policy mix ie

stealingQE which (1) deliberately distorts interest rates downwards and (2) increases asset prices to deliver a wealth effect and stimulate aggregate demand.All a bit of a mess really.

milky1980Free MemberPosted 7 years agoThe bubble is still growing here, saw some friends yesterday who are looking to move from a 2-bed to a 3-bed house.

They bought a mid-terrace house in Cardiff (in a decent area so no change in general stock) for £143k 3 years ago, they’ve just sold it for £188k after having an open viewing day with 40 booked viewings! List price was £180k. They have now had to book into 3 viewing days for their next house knowing full well that they will have to make their offer that day and it’ll most likely have to go above the asking price to even be considered. The viewing next week has 84 confirmed attendees 😯

That’s roughly 1/3 increase in value, in the meantime my savings for my deposit for my first place has grown by 5% (total would be 10% of a poky flat here) so I’m even further away from becoming a homeowner. If I haven’t bought in the next 5 years then I’ll struggle to get approved for any mortgage due to it most likely still being paid in my retirement. I know a lot of people would be in difficulty if the bubble bursts but something needs to happen to stave off a load of trouble in the next 20 years or so with hoardes of pensioners trying to scrape together their monthly rent while hardly eating due to a meagre pension.

molgripsFree MemberPosted 7 years agoyes but we’re talking about now!

I thought we were talking about people being in negative equity.. from the crash?

teamhurtmoreFree MemberPosted 7 years agoI read somewhere (need to dig out) that if IR were at normal levels, 40% of mortgage holders would be in trouble

I will have a hunt

thisisnotaspoonFree MemberPosted 7 years agoNot entirely. Houses range from v expensive to averagely expensive across the UK in relation to earnings but average to relatively inexpensive in relation to interest cost. This reflects the current unorthodox policy mix ie stealing QE which (1) deliberately distorts interest rates downwards and (2) increases asset prices to deliver a wealth effect and stimulate aggregate demand.

True, but reducing affordability by rising rates doesn’t solve the problem of under supply, there will still be more people wanting to live in Reading (or Cardiff, or a lot of places that aren’t just London) than there are houses for them. What it would do is increase the number of people who can’t afford to live there. It might as a result make it more affordable for those for who it’s not affordable, but if those in the middle can’t afford it, it’s unlikely to be helping those below them.

Stable prices and a sustained house building program, that saves those in the middle trying to make a life out of a difficult balancing act between stagnant wages and high mortgage repayments, means those currently saving a deposit don’t see it’s effective value eroded year on year, and stops the ‘free money’ for the boomers and BTL landlords.

All a bit of a mess really.

Very much true!

mrhoppyFull MemberPosted 7 years agoapologies, when i said ‘in the clear’ what i meant to say was ‘not in negative equity’

I get that, and negative equity is a bad place to be, but its not a easy as saying you can lose all the equity and be ‘ok’. If a drop wipes out your equity you’re stuck, tbh if it leaves you with less than 10% equity you’re stuck.

So if you’ve got 75% ltv at the moment you’d start to be in trouble with just a 10% market reduction.

badnewzFree MemberPosted 7 years agoFor what it’s worth here is my take on things:

– weve been in a low productivity environment since the 1970s

– which has meant people have had to take on debt to maintain their living standards

– that has led to the “financialisation” of the economy – the growth of debt

– which came home to roost in the 2008 crisis

– since then, central banks have tried to encourage growth through “zombie” economic measures – ultra low IRs, QE

– this manifests itself in asset bubbles (dot come, sub-prime, now tech stocks)

BUT there is light at the end of the Tunnel:

– we are on the verge of a new technological/industrial revolution

– once this gets going, productivity will increase and the economy will be less reliant on debt

The big change will be the introduction of a basic living wage, as the technological growth will not by itself create new jobs to offset the ones lost to automation

Keynes looked forward to a life in which we only had to work 2 hours a day, and spent the rest of our time at the opera.

In other words, Maslow’s bottom hierarchy of needs will be taken care of by technological innovation.

So I think the outlook for the West is positive, but there will have to be significant political changes, not least the introduction of border controls to reduce mass immigration from the poor world to the rich world.

(The poor world will also eventually benefit from these innovations too)

So to paraphrase Sheridan, the Harry Enfield character, “I can’t wait for the future, beastlyness will come to an end, we will all get on swimmingly well, and I’m really looking forward to it).

The crucial factor is to not top yourself through despair in the meantime.MrWoppitFree MemberPosted 7 years agoAnyone sold up yet?

Y’know, took the money and ran off to Croatia to buy a kibutz in the mountains?

Working on it fast as I can. This:

doris5000Full MemberPosted 7 years agoI thought we were talking about people being in negative equity.. from the crash?

ah. i thought we were talking about people who might end up in negative equity if there was a substantial house price correction that started now. In which case the most seriously at risk would probably be those with a lot to pay on their mortgage, ie. the people who took out a mortgage in the last few years (i suppose we could include some of the pre-2008 30 year, interest only, 110% LTV crew in that perhaps)

I get that, and negative equity is a bad place to be, but its not a easy as saying you can lose all the equity and be ‘ok’. If a drop wipes out your equity you’re stuck

true. but as someone else mentioned, we can’t end up with a situation where everyone comes out on top. I just think the spectre of negative equity is held up too readily as a reason why we should keep inflating the market (not necessarily by you btw). Especially when we’re in such a low interest rate environment, which makes it less of a risk than it would have been in previous years.

finbarFree MemberPosted 7 years agoSurely the massive queue of people waiting to buy houses as soon as they drop in price a bit (and I include myself in that category) precludes any significant correction?

brooessFree MemberPosted 7 years agoSo, in summary, there’s a very strong case that historically high house prices are causing massive damage to the economy and to individuals’ finances, and conversely there’s a very strong case that a crash and negative equity will cause massive damage to the economy and to individuals’ finances.

So, the current situation is unsustainable, both in terms of the economy overall and in terms of individuals’ finances. The current direction of travel is deeply damaging to all of us at some level but a sharp reversal will also be damaging. The only debate here is which group of individuals we choose to cause the harm to – the older/homeowners or the younger/renters…

For the last few years the market has been deliberately skewed in favour of the older/existing homeowners by BoE and government policy but the negative economic impact and electoral impacts of this policy are now beginning to show themselves… Osborne appears to be trying to dampen down Prime Central London, Cameron appears to be beginning to make the right noises about all the foreign (much of it criminal laundering) money in London, BoE and Osborne are both cutting off the supply of money pouring into BTL.

I think they’re trying to stop the bubble from bursting and instigate a flattening or slow deflation. Whether they can or not remains to be seen. Osborne appears to be more Politician than Finance Minister and if markets distorted by debt were that controllable then 2008 wouldn’t have happened – history shows that speculative bubbles tend to pop rather than deflate in a controlled fashion.

Time will tell.

Surely the massive queue of people waiting to buy houses as soon as they drop in price a bit (and I include myself in that category) precludes any significant correction?

Most likely they’ll be expecting further falls and will sit on their hands rather than buying before an anticipated drop in the market – that’s why bubbles pop rather than sustain. Plus, the psychological shock could well pull the economy back into recesssion and FTBers will be concerned about their jobs and unwilling to take on a load of debt, or banks will be unwilling to lend…

doris5000Full MemberPosted 7 years agoThe only debate here is which group of individuals we choose to cause the harm to – the older/homeowners or the younger/renters..

realistically i think it’s more a choice of the young who have recently bought, or the young who haven’t.

Most older homeowners have paid off the mortgage, probably aren’t banking on using a capital gain to fund their retirement, and would be reasonably well insulated from a crash. Perhaps not all, but more homeowners are mortgage-free than not.

Hob-NobFree MemberPosted 7 years agoRound my parents way Surrey/Sussex border, prices are still rising at a bonkers rate.

They decided last year they wanted to move, had agents in & got some valuations, but that’s as far as it went.

Fast forward to last week, they finally took the next steps. House revalued, up another 50k (~8/9%) in 8 months. First day on the market, first viewer, offer in for asking price with no chain.

That amount of money for a 3 bedroom cottage blows my mind. They bought it 7 years ago for 310k & have spent about 20k on cosmetic stuff and general modernisation. The growth rate is a joke & completely unaffordable for your average person, yet Mr Average & his family seem to be climbing over each other to drop half a million quid on a house in the SE (that’s not even that close to London in reality!).

Stereotypical example of the baby-boomer era.

We have a fairly modest 2 bedroom thatched cottage which I think cost too much money, yet it’s probably gone up a third of it’s value since we bought it in the last 8 years. Trouble is, we need to find another 200k on top to move anywhere I would consider worth the grief.

Funny old things, houses.

molgripsFree MemberPosted 7 years agoIn other words, Maslow’s bottom hierarchy of needs will be taken care of by technological innovation.

I can tell you that the robot call centre rep is not far away at all. As in, actually replacing the person rather than the automated systems we have now.

That’ll cause a bit of an economic issue, I reckon.

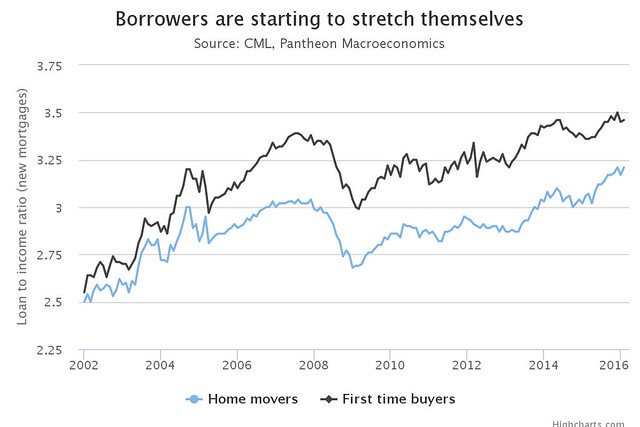

footflapsFull MemberPosted 7 years agoInteresting graph in today’s Telegraph..

[url=https://flic.kr/p/Ghx3Kb]chart[/url] by Ben Freeman, on Flickr

MrSmithFree MemberPosted 7 years agoyet Mr Average & his family seem to be climbing over each other to drop half a million quid on a house in the SE (that’s not even that close to London in reality!).

thing is that is easily achievable if 2 homeowners meet and become a couple. both me and my partner bought property later in life a few years ago (such is the way in the SE now) however we both had a sizeable deposit not scratching around for 5% and half our incomes on monthly mortgage payments.

fast forward a couple of years and we will want to buy a place together and our spending power means looking at 650k property. but having to borrow less than half the purchase price and payments less than when we both first bought due to overpayments/price increases/and extending then selling.

thats on 2 slightly above average SE incomes, i dont class ourselves as high rollers.

i would have said you were bonkers 5 years ago if you told me i would be living in a 3/4 million pound house but not being ‘mortgaged up to the eyeballs’

footflapsFull MemberPosted 7 years agoThe mean mortgage to salary ratio, for a mover, is still only 3.25x, so these people dropping half a million quid on houses in the SE are mainly able to do so because of equity they’ve already acquired.

agent007Free MemberPosted 7 years agoOk then, what credible advice would you give to a 20something now looking to buy their first house? Not buy one?

Err probably wait a couple of years to see what happens, or if you absolutely must, do your homework, don’t overstretch yourself and buy with the expectation of a crash in values on the horizon.

Surely the massive queue of people waiting to buy houses as soon as they drop in price a bit (and I include myself in that category) precludes any significant correction?

Nope not at all, if the market is correcting (dropping) then why buy now when if you wait another 6 months the house will likely be £10k (for example) cheaper?

Round my parents way Surrey/Sussex border, prices are still rising at a bonkers rate.

Prices always rise the fastest just before a big burst.

fast forward a couple of years and we will want to buy a place together and our spending power means looking at 650k property

Or you could ‘make do’ with one at £450-500k, pay off your debts early and live a life free from debt, free from worry and with lots of foreign holidays?

MrSmithFree MemberPosted 7 years agoOr you could ‘make do’ with one at £450-500k, pay off your debts early and live a life free from debt, free from worry and with lots of foreign holidays

Who knows? In that scenario I would let mine out as it’s the cheapest of the 2 and have somebody else pay my pension and simultaneously become one of the hated BTL landlords 🙄

That’s actually the smart option. Thing is I have no desire to become a landlord but that’s how things work out sometimes. And let’s not forget I paid for somebody else’s pension for a fair few years but the STW collective would obviously see me as a greedy money grabber. (Being self employed I don’t have a significant pension scheme)jambalayaFree MemberPosted 7 years agoErr probably wait a couple of years to see what happens

Look at the economics of that, if you are wrong the price rise can easily make it unaffordable. If prices fall you’ll probably spend the same money just get a better place (clearly ok)

EDIT as an aside my daughter (27) last year bought the flat in Brighton shes been renting with her husband, did it all off their own back – no parental loans etc. Just changed layout to make a second bedroom so have increased the valie further.

jambalayaFree MemberPosted 7 years agoWhat’s going to happen once we leave the EU and you get the holy grail of being able to boot all the immigrants

We may even have more immigrants once we leave, they will be controlled though and we will decode on the numbers and type of people we take (academics, tradesmen, businessmen ?). Thinking about it we could well see continued house price rises as the economy becomes yet more dynamic ?

footflapsFull MemberPosted 7 years agoWhat’s going to happen once we leave the EU and you get the holy grail of being able to boot all the immigrants

We’ll have something like 2.3m expats returning wanting somewhere to live….

trail_ratFree MemberPosted 7 years agothe crystal ball is strong in this thread.

I guess ill just live under the bridge until house prices come down.

brooessFree MemberPosted 7 years agothe crystal ball is strong in this thread.

I guess ill just live under the bridge until house prices come down.

Try looking at the debt data and The Economist article – there’s a lot of damage being done by super high prices. Pointing that out does not make anyone a doom monger or crystal ball gazer… it’s just sensible to inform yourself rather than make heroic assumptions based on religious-type beliefs…

Anyone who’s based their financial security around the assumption that house prices will go up forever is an idiot. Sensible people would be organising their finances so that they can cope with a change in their current circumstances… and not depending on a single asset class.

Did we learn absolutely nothing from the apparent total unpredictability of 2008? If nothing else we should have learnt that very serious bad things can happen with no warning at all…

The topic ‘'Boom' here we go (bubble burst content)’ is closed to new replies.