- This topic has 252 replies, 54 voices, and was last updated 11 years ago by GrahamS.

-

30% flat tax rate?

-

rkk01Free MemberPosted 11 years ago

Again????

When is TJ going to acknowledge that wealth and income are nothing like the same….

(at least he owned up to trolling after the child benefit thread got locked)I’m left leaning, so sympathise with the views. But the only “wealthy” people I know on 40%+ tax rate were already wealthy anyway.

mrmoFree MemberPosted 11 years agodo we honestly think that taxing someone at 30% rather than 45% is going to make any difference? If the maths work, i.e. the accountants cost are less than the saving the tax is still not going to be paid.

Next VAT, kids cloths are not exempt from VAT, to say they are is crap, small clothes are exempt, i was wearing adult shoes by the age of 12, hardly an adult? I still now people in their 30’s who can wear kids shoes.

I would be much happier is this government did something about the ridiculous house prices which basically screw everything else up, no ability to spend or save because everything goes on a building to live in.

joemarshallFree MemberPosted 11 years agoLondon has approximately 190,000 French expatriates, with approx 300,000 people who claim French citizenship

FACT

Not for nothing is it known as the 21st arrondissement… I suppose they’re all here for the weather, eh TJ?

Although France (apparently) has at least half a million English expats, who are also most likely concentrated in the big cities like Paris. Who presumably don’t go there to escape the high taxes of the UK?

polyFree MemberPosted 11 years agojy – so its progressive but has switched the burden from the rich to the poor. I await an explanation from THM on this FACT and how it is a progressive change

because it is not a fact – it is an error… work it out for yourself, remembering to include NI in your status quo calculation.

TJ –

Laffer curve is well known nonsense, we are not full of economic refugees from Germany and France despite taxation effectively being 10% or more higher there.Any economic theory you don’t like is presumably nonsense! I may be wrong about my details here but for most Germans the individual level of taxation isn’t that different to the UK. (42% marginal rate for earnings 50-250 EUR ?) a German earning £100k (GBP equiv) pays 35% of that in tax, the same as in the UK French income tax takes into account the number of children and adults in the house, and I think tops out at 41%, even then only when an individual earns over ~EUR70k (or a household EUR280k)+their equivalent of NI.

So its not clear that there is really a 10% differential. Even if there is, only the highest earners are most motivated to move, but if they do they have a disproportionate effect, taking not only their own taxation but investment and jobs.

Whether even with a 10% differential a Frenchman or German would chose the UK as his preferred destination is even less clear.

And as I understand it Laffer doesn’t just refer to movement of people but also the motivation for higher productivity. If “I” am earning £100k a year (I’m definitely not), and can work harder/smarter/more efficiently/take a bit of a risk with my career to earn £200k then my motivation for doing that is different if I actually get 70k to spend (as per proposed) or 50k to spend (as per status quo – assuming no ‘loopholes excercised’). Apply that logic across whole companies and you start to see the effect on the ecconomy. Then companies say “British people are lazy / too conservative etc – lets move out operation elsewhere…”

However TJ, if Laffer is nonsense – why does the SNP want the ability to control corporate taxation? Why has no scottish government implemented tartan tax… …i’ll accept its an oversimplification but nonsense?

mboyFree MemberPosted 11 years agoAlthough France (apparently) has at least half a million English expats, who are also most likely concentrated in the big cities like Paris. Who presumably don’t go there to escape the high taxes of the UK?

Don’t assume/presume… Unless you’re in possession of the facts, you don’t know, so it would be unwise to comment otherwise. Besides, I only know a few Brit ex-pats in France, and none of them live in big cities, it’s small back country life for them all the way.

I would be much happier is this government did something about the ridiculous house prices which basically screw everything else up, no ability to spend or save because everything goes on a building to live in.

Quite literally the only modern day example of where something is worth several times more than the sum of its parts… The House! It’s a bit ridiculous when you come to think about it, but then that’s what can happen when everyone is sold the dream.

do we honestly think that taxing someone at 30% rather than 45% is going to make any difference? If the maths work, i.e. the accountants cost are less than the saving the tax is still not going to be paid.

How’d you work that one out? If the accountants wouldn’t save enough money to make tax evasion worthwhile, then they’d have no choice but to pay the tax quite simply. No? 😕

polyFree MemberPosted 11 years agoMr-Mo: do we honestly think that taxing someone at 30% rather than 45% is going to make any difference? If the maths work, i.e. the accountants cost are less than the saving the tax is still not going to be paid.

you don’t understand how flat tax works. The whole point is there are no loopholes in flat tax to let the accountant work their magic on. Everyone pays the same on all income (in this case above a threshold).

tronFree MemberPosted 11 years agoThere’s a part of flat tax that’s very often overlooked – you also bin every single exemption, loophole and rebate. You pay the tax and that’s that, which makes a lot of tax dodges impossible. If you take into account that the very rich often pay well below the headline rates, having a lower but much harder to dodge rate makes some sense.

I’m not saying that 30% is where the rate should be set, or even that a flat rate is particularly desirable. But overall, if you simplify tax, you make it harder to dodge, you can put taxmen, lawyers and accountants to an economically productive use…

Saying “stop the rich buggers dodging tax in the system we have” is all well and good, but if it were that easy (and there was a payback to it) then someone would.have already done it by now.

allthepiesFree MemberPosted 11 years agoTJ will disappear into some kind of recursive wormhole after reading that.

mrmoFree MemberPosted 11 years agothere are always loopholes, you can say everyone pays x%, now prove what they earned? If you really think that you can implement a system where there are no loopholes….forget it, it isn’t going to happen. Money can always be shipped off shore, through third parties, via companies, payment doesn’t have to be in money etc.

tronFree MemberPosted 11 years agoThat’s why I said “which makes a lot of tax dodges impossible”.

If you’re really determined you can mess around with things like transfer pricing etc. but ultimately simplifying the system makes tax avoidance harder.

loumFree MemberPosted 11 years agoIts a giant tax cut, with proportionately more for the higher rate tax-payers, dressed up as a system change.

Read the report. We’d be down by 50 billion as a country. That’s really going to sort the deficit.

For all the side arguments about what constitutes flat rate, progressive tax, or France, there’s still no explanation as to how a further 50 billion pound deficit would help the country.allthepiesFree MemberPosted 11 years agoFrom the article:-

The commission says shifting to a single income tax rate would add £49.1bn to the national deficit in the first year, if the changes were not phased in or if spending were not cut further.

But it predicts that after 15 years the change would actually reduce overall borrowing by £35bn.

Perhaps you missed the second sentence when you read the report ?

teamhurtmoreFree MemberPosted 11 years agoWell economic journals are normally so dry and challenging for a non-mathematician, so refreshing to read something contraversial that agrees with me that economics is best studied in the context of philosophy and politics. So instead of multiple regression there are chapters on utilitarianism, deontological ethics, virtue ethics, libertarianism and religious perspectives. Whatever one thinks of the conclusions, that makes for a more interesting read than normal. How refreshing.

loumFree MemberPosted 11 years agoallthepies – Member

Perhaps you missed the second sentence when you read the report ?No, just not as gullible as you. 🙄

There’s absolutely no evidence to back the empty promise of the second sentence.

If I said to you give me £50 billion now, even if you don’t have it, and that will make you £35 billion better off in 15 years time would you trust me?

What if you were already in debt by over £100 billion a year?

Would that sway it for you?

Would you trust me more if I was a finance profesional?

They’ve never got it wrong before, eh?teamhurtmoreFree MemberPosted 11 years agoFunny enough loum – that’s happening pretty much already.

So Spain and Italy are forcing banks and pension funds to buy their debt at unattractive rates. Oh, and the banks don’t have any money. Dont worry, the ECB will lend it to you. You couldn’t make it up….the European ponzi swindle.

…but then professionals are investing OUR pensions to lend to the US government for ten years at <2% when US inflation is 2.5%. Thanks, here take my savings to subsidise the US government. And I pay you to do this??

The world is a funny place!!

JunkyardFree MemberPosted 11 years agoJY – I am sorry, but I am not sure I understand the question you are asking.

Poor sidestep? Poor very poor. I really did expect more from you

because it is not a fact – it is an error… work it out for yourself, remembering to include NI in your status quo calculation.

It is an error [ the calcuations on how much we pay under this flat rate] because they only way they could do this was to have a shortfall of income tax raised under their system or else we would not all get a tax cut [ reduction in the % of the burden we pay]

If you use a flat rate tax and generate the same amount as now the poorer/less well off subsidise the wealthier . If the wealthier pay less [ the only reason to have this tax obviously] someone has to pay more so we get the same income from tax- this is obvious without doing any maths. I am sure the Tax Payers alliance know this as well hence the “shortfall”Everyone pays the same on all income (in this case above a threshold).

Woah there woah there no they don’t remember it is progressive and the rich pay more ..stay on message FFS 😉

But overall, if you simplify tax, you make it harder to dodge

Possibly true but this does not necessitate a flat rate. i.e we can simplify the system without having just one rate.

The commission says shifting to a single income tax rate would add £49.1bn to the national deficit in the first year, if the changes were not phased in or if spending were not cut further.

But it predicts that after 15 years the change would actually reduce overall borrowing by £35bnI actually went to the report to see the maths behind the claim re debt and read the intro

It is time for Britain to make a vital choice. Our economy is stagnant, crippled by excessive public spending, a mismanaged and inefficient public sector, an extraordinarily complex and punitive tax system and a public mood that has become increasingly anti-capitalist.

So there you have it the whole thing is **** up and crippled because of the public sector [ not the private sector ] 😯 . It is like they are politically motivated or something. I mean seriously WTF would need to happen to get these people to think the current problems were caused by the private sector and the failings of capitalism if the current problems are not enough. Many on here have a political stance but FFS that is like me claiming Russia was the land of riches and milk and honey poured as every citizen lived in bliss and joy. I don’t think I can take anything they say seriously tbh Can I call them swivel eyed loons yet?

There was little in the summary to back their claims but it appeared to rely on modelling, growth predictions [ greater under their system] and reducing the “shadow economy” so forgive me if I remain unconvinced.

I read the summary I could not face the full report so I am sure there will be some maths there somewherepleaderwilliamsFree MemberPosted 11 years agoAnd as I understand it Laffer doesn’t just refer to movement of people but also the motivation for higher productivity. If “I” am earning £100k a year (I’m definitely not), and can work harder/smarter/more efficiently/take a bit of a risk with my career to earn £200k then my motivation for doing that is different if I actually get 70k to spend (as per proposed) or 50k to spend (as per status quo – assuming no ‘loopholes excercised’). Apply that logic across whole companies and you start to see the effect on the ecconomy. Then companies say “British people are lazy / too conservative etc – lets move out operation elsewhere…”

However TJ, if Laffer is nonsense – why does the SNP want the ability to control corporate taxation? Why has no scottish government implemented tartan tax… …i’ll accept its an oversimplification but nonsense?

Laffer isn’t nonsense, however, all the theory really says is that at 0% tax and 100% tax, tax income is £0, and that somewhere in between there is a point at which tax income is maximised. I think everyone can agree that that much is true. Unfortunately no-one agrees what rate of tax is optimal, as it depends on a huge number of variables, including motivation of the work force, and attracting/putting off workers/businesses. Studies have found that anything from 24% to 70% might be optimal, depending on the particular situation they are studying, and of course on the bias of those doing the studies.

You are welcome to say that tax increases will actually decrease tax income, and others are can say that they wont. You will both be able to point to evidence (albeit flawed) to back up your point of view, but the reality is that no-one really knows until a long time afterwards.

teamhurtmoreFree MemberPosted 11 years agoJY – be serious for a moment. You know that was a genuine question because I was sure that you understand the basic maths. The quote that you asked for explanation ie the squeezed bit and the issue of being progressive. A flat rate tax system with a minimum threshold is progressive – FACT. Dont be silly about the everyone pays the same thing – they pay the same tax rate on taxable income but the effective tax rate increases as income increases. Hence it is a progressive tax regime.

The totally separate issue is whether this is makes certain people less or better off. Hence there is the valid debate as to whether it is less progressive than the current system….which others were dragged reluctantly to admit.

Hence to natural bias of the authors – this is hardly going to be a left/center left agenda is it? And they are very open about this. Hence page 29 – “these proposals are not revenue neutral. The dysfuntion of the tax system is to a large extent an inescapable function of the amount of revenue it is trying to raise.”

And their philosophical arguments, while interesting (?), present subtle differences (polite version) to exactly the same points raised by Michael Sandel at Harvard (whose lecture on the subject I was incidentally listening to yesterday morning while dog walking). Some would call it bias!! Sandel is not a fan of markets per se and far more influenced by Rawls (which somewhat interestingly they also quote in the middle of the report).

Buy it, you would love the read!

And funny that you mention Russia – there tax system is …..? And it raised or lowered the tax take?

[edit: lots of data and words !! but very little maths in fact. Very unusual given the topic. Makes it easy to read but frustrating if you want to see the basis for the calculations. Perhaps they should have put a simple table showing why the system is still progressive to kill that chestnut off at the start.]

TandemJeremyFree MemberPosted 11 years agoHowever TJ, if Laffer is nonsense – why does the SNP want the ability to control corporate taxation? Why has no scottish government implemented tartan tax… …i’ll accept its an oversimplification but nonsense?

There are good resons for both of those things that asre nothing to do with laffer curves. Teh very fact you refer to these two issues to support your argument shows the poverty of your position

Its one of those myths / dreams of the far right that is at best far from proven and at worst is utter bunkum but that those who are on the right take as fact and treat as fact as it backs their position.

They hope that by carrying in treating this vague theory from the right wing fringes as fact it will be accepted as fact – well I and many others am not that gullible even if you are.

Laffer isn’t nonsense, however, all the theory really says is that at 0% tax and 100% tax, tax income is £0, and that somewhere in between there is a point at which tax income is maximised. I think everyone can agree that that much is true.

Nope – maost sensible folk do not believe this to be true. tax take increases as tax rates increase. You might only get a 5% increase in take for a 10% increase in tax but the whole basis of the laffer curve that total tax take will start to fall at some point is a the very best unproven theory.

If the right wing want to be believed on this stuff they need to stop treating unproven theory as fact

Zulu-ElevenFree MemberPosted 11 years agothe whole basis of the laffer curve that total tax take will start to fall at some point is a the very best unproven theory.

TJ – would you go to work for nothing?

If we imposed 100% taxation, then do you think people would still go to work for no reward?

Do you think they would be able to go to work for no reward?

No, of course not – so, the theory of the Laffer curve is solid – 100% taxation would lead to a fall in taxable revenue, and the tipping point is somewhere between 0% and 100%

the argument you appear to be trying to make, is that the latter curve tipping point is higher than anyone currently taxes, however that does not undermine the fact that the curve still exists, you’re simply arhuing where the top of it is.

TandemJeremyFree MemberPosted 11 years agoNo I am not Zulu. I am saying its an unproven theory with no real data behind it that is taken as a truth by people like you as it backs up your ideas.

Its all about finding the point you want to make than making a theory to back this up.

Zulu-ElevenFree MemberPosted 11 years agoOf course there is real world data

What happened when Thatcher lowered the top rate of income tax in the 80’s?

did overall tax take increase, or decrease?

What about the magical 50p tax – did it increase or decrease the tax take?

Its quite simple – Higher income tax rates incentivise taxpayers to work less, retire earlier, emigrate, contribute more to pension or charity, convert income to capital gains, incorporate, and invest in tax avoidance.

TandemJeremyFree MemberPosted 11 years agoWell one man I know saved £100 000 pa on his tax bill so that was certainly a large net loss.

Zulu-ElevenFree MemberPosted 11 years agoYou seem to be confusing anecdote with statistics TJ

Which was it, did total tax revenues go up, or down?

mcbooFree MemberPosted 11 years agoTJ – You are a modestly paid public servant right? Do you not think you might feel differently if you earned more than you do?

TandemJeremyFree MemberPosted 11 years agoYawn

Down of course reduce the rate of taxation reduce the tax take.

I am sure you will have some bogus distorted nonsense ready to show that the tax take went up as the rate fell – just make sure its actually vliid ie accounts for inflation,other taxation changes adn rising incomes and actually compares like with like

teamhurtmoreFree MemberPosted 11 years agoTJ – also widely used by HMRC, so there’s an opportunity for you. You can consult for them and explain how they should make the calculations correctly.

http://www.hmrc.gov.uk/budget2012/excheq-income-tax-2042.pdf

Page 51 The Laffer Curve analysis : They would probably pay you £40k plus to sort it out – in fact a lot more.

[p.s. try to mention taxable income elasticity at some stage in the pitch/interview process]

edit to make it easy: “TIEs are extremely important to policy decisions since they are critical in producing accurate costings of policies. If the response measured by the TIE is large then people will reduce their taxable incomes by a large amount in response to a tax increase. Increasing tax rates will result in a smaller increase in tax revenue than would have been expected because of this fall in taxable income. If the TIE is large enough then it is even possible that the increase in taxes could result in a sufficient fall in taxable income to cause a net decrease in tax revenues.“

Bloody inconvenient all this economics isn’t it?

TandemJeremyFree MemberPosted 11 years agomcboo – Member

TJ – You are a modestly paid public servant right? Do you not think you might feel differently if you earned more than you do?

Nope – I know I would not. I am not a selfish begger my neighbour type. I am a public servant. I beleive in public service. I am not motivated by avarice

Zulu-ElevenFree MemberPosted 11 years agoSo, on that basis – would you be willing to take a pay cut TJ?

If all NHS workers took a 10% pay cut, waiting lists would be a thing of the past, as we could afford to employ more staff!

if only those NHS workers earning enough to pay higher rate tax (who are, by definition, among the top 10% of wealthiest people in the country) took a pay cut, we could treat more people.

sounds fair, doesn’t it?

TandemJeremyFree MemberPosted 11 years agoIt must be great to live in the lala land of THM and zulu et al.

At least Zulu is honest about what he is tho. I do prefer that to the pretence of THM

Pointless debating this with these folk tho. they only believe what they want to believe and will believe any old nonsense that supports their hatred of taxation

teamhurtmoreFree MemberPosted 11 years agoTandemJeremy – Member

I am sure you will have some bogus distorted nonsense ready to show that the tax take went up as the rate fellFunny you should mention that….

In January 2001, Russia introduced a fairly dramatic reform of its personal income tax, becoming the first large economy to adopt a flat tax. The Tax Code of 2001 replaced a conventional progressive rate structure with a flat tax rate of 13 percent. Over the next year after the reform, while the Russian economy grew at almost 5% in real terms, revenues from the personal income tax increased by over 25% in real terms. Besides this revenue yield performance, advocates also have credited the flat tax with beneficial changes in the real side of the economy. The Russian experience would appear to have been so successful that many other countries have followed suit with their own flat rate income tax reforms, and an increasing number of countries around the world are considering the adoption of a flat rate income tax.

Could have been completely un-related of course! Causation vs Correlation and all that nonsense 😉

polyFree MemberPosted 11 years agoLou – Its a giant tax cut, with proportionately more for the higher rate tax-payers, dressed up as a system change.

Read the report. We’d be down by 50 billion as a country. That’s really going to sort the deficit.

For all the side arguments about what constitutes flat rate, progressive tax, or France, there’s still no explanation as to how a further 50 billion pound deficit would help the country.Only on the numbers chosen in the discussion document. e.g. why is the magic round number of £10k the right threshold value, why is the round number of 30% the perfect solution? There will be a way of having the same simp lied flat tax system at say £9750 threshold and a 31.4% tax rate which actually means the deficit doesn’t get worse. I have no idea what those numbers are – but they are largely irrelevant to whether a flat tax is a better system or not. What happens at budget time at the moment is they bugger about with all the thresholds and rates so nobody is clear who is better or worse off. With flat tax you increase or lower one rate which helps or penalises everyone by the same %age. With this variation involving a threshold you have two parameters to play with if you want to pretend to be more or less progressive.

TJ – congratulations I think you might be the first person ever to suggest I am from the “far right”. Laffer is just a straightforward economic argument similar to price elasticity models used by companies all the time and well proven – but applied to taxation. The underlying assumption has to be that those who would pay the most are able to do something about it, e.g. by evading tax, by avoiding tax through legal means, or by moving location. The wealthiest are generally most able to achieve those things, and most motivated to do so because the cost is greater. The unknown part is at what point is the tipping point achieved. But “Laffer” is already happening all around you, and you can put the blinkers on if you want but both in Corporation and Income tax worlds the people using legal mechanisms to avoid tax are those with the highest rates and biggest bills. So since you didn’t answer my question – if Scotland had a significantly different tax rate to the rest of the UK do you think people would relocate to exploit the system to their advantage? Now is it possible that by reducing tax %age you can encourage enough inward investment to increase employment and actually get more £ overall?

teamhurtmoreFree MemberPosted 11 years agoTJ – you can hide behind the personal insults, the distortion of the truth and the failure to grasp basic economic principles such as elasticity and progressive tax systems if you want – but it wont change the facts. Perhaps JY sums it up best:

Junkyard – Member

TJ I tend to have similar views to you but really you dont help your argument or the left very much.There are plenty of reasons to criticise/deabte this particular report without lying!!

poly – Member

TJ – congratulations I think you might be the first person ever to suggest I am from the “far right”.A frequent tactic when all else is lost!

poly – Member

Laffer is just a straightforward economic argument similar to price elasticity models used by companies all the time and well proven – but applied to taxation.Sometimes simple things are hard to take!!

Zulu-ElevenFree MemberPosted 11 years agoaha – back to the good old ad-hominem attacks TJ, quelle surprise

come on – what happened when Thatcher dropped the top rate – did the overall share paid by the top ten percent increase, or decrease?

they contributed 32% of the tax take before the cuts, they were contributing 45% of it afterwards.

there’s your real world proof.

come on, shoot it down with actual data that supports your contention that the Laffer curve does not exist, rather than p- poor anecdote and ad-hom.

Tell you what – I’ll offer you the best possible proof that the Laffer curve exits, that if you tax pepople too high, they simply leave and go somewhere else

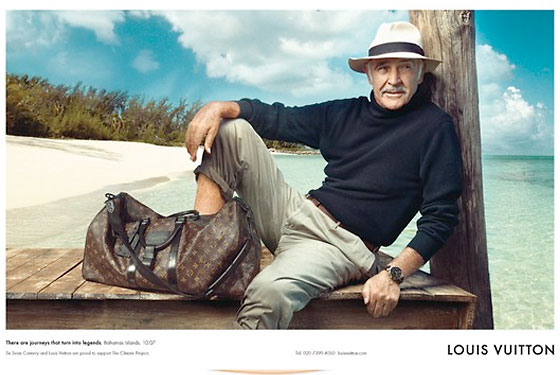

Where does Sean live TJ?

That beach and those trees don’t look much like Musselburgh to me!

TandemJeremyFree MemberPosted 11 years agoThe underlying assumption

Thats the point. 🙄 assumption.

Lets try this one.

Benefits are sometimes fraudulently claimed – people work and do not declare it. would increasing benefit levels lead to less fraud and thus lower costs in the benefits system?

this is the logic followed by the laffer curve

.So the adherents of the laffer curve should be arguing for increased benefits. But they don’t – they argue for lower benefits.

CaptainFlashheartFree MemberPosted 11 years agoOh look, I go away for a few days and it’s all the same. Same people having the same circular arguments as ever, and all on a relatively obscure bike forum.

It’s nice and sunny outside. Go for a ride.

TandemJeremyFree MemberPosted 11 years agoTime to leave this thread to the fantasists.

Poly

It would be interesting to debate some of that with you as there are several logical leaps in your post.

However the presence of THM and his frankly dishonest nasty patronising and deceitful postings ruins it.

The topic ‘30% flat tax rate?’ is closed to new replies.