- This topic has 63 replies, 30 voices, and was last updated 10 years ago by thekingisdead.

-

What is the 40% tax bracket?

-

njee20Free MemberPosted 10 years ago

I must admit in my youth I thought it was absolute bands, so if there was a threshold at £100,000, I thought you effectively took home more if you stayed earning £99,999. 😳

BigJohnFull MemberPosted 10 years agoMoreCashThanDash – Member

Our joint income wouldn’t hit the higher tax bracketYou can’t have a lot of dash then.

oldnpastitFull MemberPosted 10 years agoOne of my colleagues, who is approaching retirement, put his entire salary into his pension one year and lived off his wife’s salary. He paid no tax at all even though he’s in the 40% bracket….

Haven’t they clamped down on that now? There’s a cap of £40k p.a. for this coming tax year, and a lifetime cap as well.

Sadly, not a problem I need to grapple with.

peterfileFree MemberPosted 10 years agoOne of my colleagues, who is approaching retirement, put his entire salary into his pension one year and lived off his wife’s salary. He paid no tax at all even though he’s in the 40% bracket….

He must have only just been in the 40% bracket then, that’s a spot of good fortune!

footflapsFull MemberPosted 10 years agoIt was a few years back, before they lowered the limit to £50k.

gordimhorFull MemberPosted 10 years agoWhy would I like to pay 40% tax? Because my income would have more than doubled .

TheArtistFormerlyKnownAsSTRFull MemberPosted 10 years agoAy thats true, but why leave all that loverly dosh sitting in the Co Bank Account when there are bikes to pay for

Dividends dear buoy, dividends.

And as for leaving any spare cash in the Co Account – well, your partner needs a salary too, dependent on how much her day job pays, because she is your company secretary, ISN’T SHE?

Oh and you know that car you use for work? 50 pence per mile for the first 10k and 25 pence thereafter can soon add up.

Add in pensions and…

VOILA, no corporation tax to pay and Ltd Company broke even this year 😉

shifterFree MemberPosted 10 years agoThat’s a great result for you. Do you actually feel good about not paying any tax? Hospitals, schools, roads – do you ever think “hmmm, it would be nice if these were a bit better looked after” ?

TheArtistFormerlyKnownAsSTRFull MemberPosted 10 years agoshifter – Member

That’s a great result for you. Do you actually feel good about not paying any tax? Hospitals, schools, roads – do you ever think “hmmm, it would be nice if these were a bit better looked after” ?

If that comment is aimed at me, then wind yer neck in – it was a hypothetical scenario. I’m a Sole Trader and pay plenty of tax thanks.

However, even with the above, I’d still have paid plenty of tax. Where does your ‘not paying any tax’ nonsense come from?

shifterFree MemberPosted 10 years agoOh I see now, it was hypothetical. The sole traders I know are quite willing to share that they pay as little tax as possible so if you’re paying plenty then I commend your public spiritedness. I’ll put my neck wherever I like thank you!

TheArtistFormerlyKnownAsSTRFull MemberPosted 10 years agoMaybe the sole traders you know are a tad dishonest then? Money in/money out, pay the due rate of tax on the difference. You can make up any figures you like, as long as you can confidently back up those figures for the next 6 years.

So, you mump at me for having a pretend Ltd Company and utilising the tax system, then you seemingly tar me with the same brush as your dodgy mates, with your veiled praise of my public spiritedness.

Your neck still seems to be out, but I’m not sure why. What’s your problem?

pictonroadFull MemberPosted 10 years agoIf your tax free allowance is reduced to £7k because of a company car, do you start paying 40% earlier or does it not work like that?

craigxxlFree MemberPosted 10 years agoIt does. If you have a K code then you’ve used all you tax allowance up and the excess benefit in kind is taxed on top of your salary.

gonefishinFree MemberPosted 10 years agoIf your tax free allowance is reduced to £7k because of a company car, do you start paying 40% earlier or does it not work like that?

Yes, you would start to pay tax at 40% at a lower salary than someone who didn’t get a company car. Bear in mind that a company car is still cheaper than paying for the same car yourself.

pictonroadFull MemberPosted 10 years agoOk. So if you just tip into 40% by a few quid, does the bike to work scheme work at 40%?

craigxxlFree MemberPosted 10 years agoCycle to work payments come out of your gross earnings before taxes so reduce the taxable amount. If you were just in the 40% bracket then then the payments may drop the remaining salary below the higher rate threshold.

johndohFree MemberPosted 10 years agoIf you are a sole trader/partnership you can’t use the bike scheme.

But you *can* buy a bike through the business and it’s an allowed expense and you can claim the VAT back 😉

pdwFree MemberPosted 10 years agoYou’re not wrong, but I think robdixon’s point is that people earning between £100,000 and £149,000 are paying a lot more tax then people earning £150,000 and over

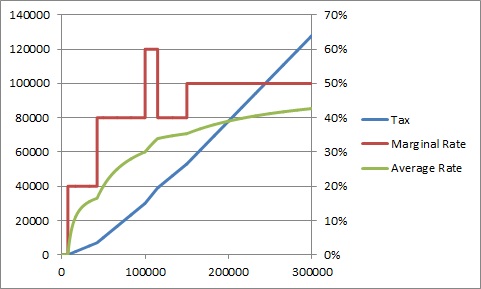

No, it’s even more bonkers than that. The marginal rate goes up to 62% between 100k and 118k or so whilst they remove your personal allowance, then back down to 42% until you hit £150k then up to 47%. This is neither progressive nor regressive, it’s just bonkers.

What’s even more silly is that because its been implemented by removing your PA, it’s almost impossible for the PAYE system to get your tax right, because your tax code becomes dependent on how much you earn, making the tax system even more complicated and difficult to administer. This has been done because the notion of high earners getting a “tax free allowance” is politically unacceptable, even though you could achieve an equivalent effect much more simply by reducing the £150k threshold.

Further, because the £100k and £150k thresholds are seen as the preserve of the “rich”, there’s never any discussion of raising them in line with inflation which means that ever more people will creep into these brackets. Already £100k today is probably equivalent to less than £90k when the change was introduced, and it will continue to affect more and more people, just like the 40% band.

I’ve no problem with higher rates for higher earnings, but it’d be really nice if it could be implemented simply and logically.

footflapsFull MemberPosted 10 years agoMarginals rates are meaningless, all that matters is the overall tax rate on all your earnings.

Plus you can easily avoid the higher marginal rates by investing in SIPPs etc.

teamhurtmoreFree MemberPosted 10 years agoMost decisions we make are “marginal” hence it is a central theme of economics. So would disagree with the idea that marginal rates are meaningless.

pdwFree MemberPosted 10 years ago+1 Marginal rates are what drive decisions around whether it’s worth working harder and trying to earn more.

thisisnotaspoonFree MemberPosted 10 years agoNo, it’s even more bonkers than that. The marginal rate goes up to 62% between 100k and 118k or so whilst they remove your personal allowance, then back down to 42% until you hit £150k then up to 47%. This is neither progressive nor regressive, it’s just bonkers.

Maybe, but the total rate still always goes up with earnings, just not in a smooth curve.

I like marginal rates because I can tell my boss to shove the overtime where the sun don’t shine because for the next few years it’ll net less than it did when I started at the company!

thekingisdeadFree MemberPosted 10 years ago+1 Marginal rates are what drive decisions around whether it’s worth working harder and trying to earn more.

Which always makes me wonder why high earners are de-motivated to work harder if we take to much money off them, yet low earners / benefit claimants will be motivated to work harder if we take money off them?

The topic ‘What is the 40% tax bracket?’ is closed to new replies.