- This topic has 272 replies, 47 voices, and was last updated 12 years ago by teamhurtmore.

-

Removing 50p tax rate – seems to be a BBC campaign

-

rightplacerighttimeFree MemberPosted 12 years ago

For the second time in a week the BBC has given this story extremely high prominence on its web page.

When the 20 economists signed their letter the other day it was the TOP news story for the day, and now we have a story about how that wrinkled old has-been Nigel (Davros) Lawson thinks it should be abolished too.

What is going on?

I feel we are being softened up for the results of Cameron’s “independent” report into whether the 50p rate actually generates any revenue.

I can see his oily hands all over this orchestrated campaign.

(Just because you’re paranoid doesn’t mean they aren’t out to get you.)

oldnpastitFull MemberPosted 12 years agoWhat’s the point of being rich if you can’t change the world to suit yourself?

Not that I’d know 😥

EDIT: if it turned out that (say) the 20% tax rate was damaging the UK economy and more revenue would be raised if it were reduced, I wonder how much these people would be talking about it?

uplinkFree MemberPosted 12 years agoWhen the 20 economists signed their letter the other day

What is going on?

Ask yourself a question – “who benefits”?

In the film, All the Presidents Men, the whistleblower – deep throat – kept urging Bob and Carl to “follow the money”

The answers lies at the end of the money trailJunkyardFree MemberPosted 12 years agothe 50p rate – which affects about 310,000 people –

why do so many folk who will never ever earn anything like 150 k care about this?

I dont think they can all just leave – many will be tied to this country such as tv performers, footballers and due to the job so to suggest they will leave is just bollocks

obvious what george wants to do but then again on the day he announced his growth forecast was massively reduced he did say this

“We will stick to the deficit reduction plan we have set out. It is the rock of stability on which our economy is built.”

and cameron this

“This is a government with a hugely ambitious growth plan and a hugely ambitious jobs plan”

unfortunately their right wing political view is strong it can deflect reality.brFree MemberPosted 12 years agoThe only reason that it ‘only’ affects 310,000 people is that all the rest have already ‘managed’ their tax exposure…

And tbh its more about the fact that the government is taking half of what you earn – and more if you add in NI – come to think of it, at 40% you almost pay that too…

donsimonFree MemberPosted 12 years agoAnd tbh its more about the fact that the government is taking half of what you earn –

Isn’t that taking half you earn over the 150k as opposed to 40% of what you earn over 150k? Not as big a difference as the headline 50% would suggest, is it?

binnersFull MemberPosted 12 years agoGood article in the Guardian by Simon Jenkins, Hardly renowned for his leftie tendencies

our trickle-up economy

A good quoteWhenever 20 economists put their name to a letter it is a near certainty that nonsense is being perpetrated.

oldnpastitFull MemberPosted 12 years agoI personally would be perfectly happy with this if it weren’t for the fact that I instinctively distrust everything that George Osborne says or does.

stevewhyteFree MemberPosted 12 years agoI would rather all the folk who complain about paying their 50% rate would **** off to another country and take their selfish attitudes with them, WE DONT NEED YOU.

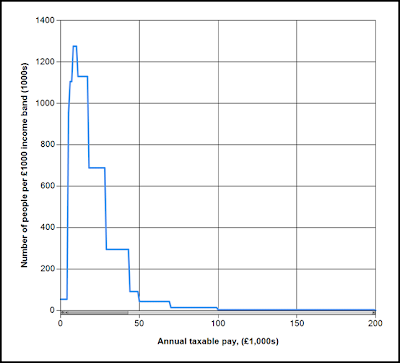

StonerFree MemberPosted 12 years agoPS, someone here: http://somebeans.blogspot.com/2010/10/yields-from-income-tax.html

has taken the tax clalc thing on a step and dug out UK income distribution and hence tax yield:

rightplacerighttimeFree MemberPosted 12 years agoStoner,

You seem to have forgotten to apply the effect of a good tax accountant to your effective income tax curve.

(obviously it only makes a difference to the right hand end)

mashiehoodFree MemberPosted 12 years agoThe 50p tax’s sole purpose is to hurt a few people and fuel class warfare. Even those on low incomes who will never pay the tax will be worse off because of it. It is also a myth to believe that the “rich” do not pay much or enough tax in today’s Britain.

If you don’t believe me, take a look at the facts. There are 29.9m income tax payers (out of a population of 61.8m) who earn at least £7,475. Roughly 727,000 people have an income of at least £100,000 a year. Of these, 369,000 earn £100-150k; 157,000 earn between £150-200k; 158,000 earn £200-500k, 29,000 between £500k-£1m and 14,000 earn a £1m or more.

This implies that 358,000 people earn £150,000 or more; roughly 308,000 of these pay the 50p rate. Some of these will be non-doms, who pay full UK income tax on UK earnings (but also derive earnings from overseas, which are not taxed). These figures do not include capital gains.

A huge share of the tax take and hence of the money used to fund the NHS, schools and welfare is accounted for by a tiny minority on high incomes. The top one per cent of taxpayers (roughly speaking, those on £150k and above) will pay a record 27.7 per cent of the total income tax take in 2011-12, according to HMRC (they earned 12.6 per cent of total income, down from 13.4 per cent five years ago). This has increased from 26.6 per cent the previous year, 21.3 per cent in 1999-2000, 14 per cent in 1986-87 and 11 per cent in 1981-2. History tells us that cuts to the top rate actually increase the share of tax paid for by the rich; there was no need for Gordon Brown’s raid.

Another astonishing statistic is that the 14,000 people on £1m a year or more will pay £14.2bn in income tax this year. They will contribute almost as much to the exchequer as the total paid by the 13.93m people earning up to £20,000 a year, who will fork out £14.9bn. Those on £1m or more now pay 45.5 per cent of their income in income tax, up from 35.7 per cent in 2008-09 (they also pay national insurance).

JunkyardFree MemberPosted 12 years ago‘only’ affects 310,000 people is that all the rest have already ‘managed’ their tax exposure…

ah that other claim to they will all leave the country is that they all manage to avoid it so less tax. Both are excellent claims in the sense that they are near impossible to disprove – or prove obviously. Even if it were true the loop holes could and should be closed.

MartynSFull MemberPosted 12 years agoLoads of people at the BBC pay the 50% rate. Hmmmmm……

bollocks….

rightplacerighttimeFree MemberPosted 12 years agomashie

take a look at the facts.

This implies…

See any problem here?

You seem to be forgetting that most rich people put great wadges of cash into their pensions and don’t pay any tax on it untill later life. Or that they transfer wealth into their spouse’s name or they invest it offshore etc etc. All things that lower level tax payers don’t have the chance to do because they need their wages to pay the bills.

mashiehoodFree MemberPosted 12 years agoRight place you miss my point, I am merely supporting my argument for abolishon of the 50p tax because taxing the rich more is to the detriment of the wider economy

FlaperonFull MemberPosted 12 years agoMy view (as someone who doesn’t currently pay the top rate) is that it’s a pointless propaganda exercise left over from Labour. Raises a minuscule amount of extra money and simply serves to piss off the people, who as a proportion of the population, contribute the most.

A far more effective strategy would be to go after the people who “manage” their taxes so well they pay nothing. Who cares if some of them leave the country? We’re not losing anything – I imagine their expertise in their particular field is not unique – and we stand to gain a lot. This isn’t going to happen, and this, I suspect, is the direct result of too many people who do it having their fingers in the Conservative pie.

The reclaimed money could be used to abolish the 10p tax rate, which has to be one of the most unfair taxes we’ve ever had, something which deliberately penalises the poorest members of society. I’d be quite happy to see the threshold at which I pay tax reduced in order to get rid of the 10p rate. Bloody Tories and their policies against the poor- oh, wait a minute… 😉

Mars2003Free MemberPosted 12 years agoThe proposal to abolish the 50% rate is usually supported by the concept of the trickle down effect of wealth.

Unfortunately it’s quite apparent that these high earners have been focused on at plugging this trickle down and ensuring that they get richer a damn site faster the the general public. My experience over the past 10 years has moved me from a pro market view to a view that capitalism is unsustainable and currently broken.

I’m trying to remember these figures off the top of my head, but whilst average wage has gone up 29% in the past 10 years, CEO level wages have risen 183% and the value returned to the actual owners (shareholders/pension funds) of companies has fallen. For this reason we can’t just look at what happened in the 80’s and assume the same will happen without some other drastic measures taken to reign in this manipulation of the market from the top.

Abolish the 50% rate if you want. IMHO it’s time to cap remuneration for all employees including the Exec levels of companies to a multiple of what their average employee earns. Huge profits should be reserved for those that risk only their own money (i.e. real entrepreurs) and should not be for those risking other peoples money.

rightplacerighttimeFree MemberPosted 12 years agoWell then, lets see the “facts” that you mentioned then.

SurroundedByZulusFree MemberPosted 12 years agoThe longer this government is is power the more they begin to resemble nazis.

uplinkFree MemberPosted 12 years agoThe total income tax paid by the STW forum members is [in the scheme of thing] minuscule

It is stifling the growth in shiny bike parts economyLet’s abolish all income tax for us for the good of the country

TandemJeremyFree MemberPosted 12 years agoBillions of pounds raised by this tax. what contorted logic says that lower paid people must have wages cut but higher paid people need their taxes cut.

TandemJeremyFree MemberPosted 12 years agoTop tax rate will raise £12.6bn more in revenue, official figures reveal

Government’s own projections favour 50p tax rate for highest earners as pressure mounts on George Osborne to scrap it

http://www.guardian.co.uk/money/2011/sep/07/top-tax-rate-george-osborne

polyFree MemberPosted 12 years agoI don’t pay 50% tax, and am unlikely to! But I still think its not a great idea. The people that do usually employ a reasonable number of people, are often business owners probably paying corporation tax too, but will also be getting good tax advice so avoiding as much as possible. e.g. if you don’t actually need the cash then putting it in a pension avoids the tax and guarantees future security… …nice for those at the top, although I can certainly see that incentives for investing, and supporting the UK economy are worthwhile. I don’t think that many will up sticks and move overseas but I can certainly see that some who are overseas at the moment will choose not to come here, and those who are already here will be looking for “loopholes” which actually end up moving a large proportion of their tax outside the UK system.

To me the bigger issue is the 40% rate. It applies at a level where many people do encounter it. They aren’t the “super rich” they are just professionals doing OK in their career. When they move over the threshold of £43k (ish) suddenly increased salary makes sod all difference as half the money goes in tax/ni. What incentive is their for someone on 40k to move up the career progression to 50k when they will barely notice the change in take home pay. Worse still a household can earn more money, and get tax incentives (child care vouchers) if both parents go out and work full time earning say £25k per annum than if one works earning £50k… that is screwed up and a total disincentive for people who might aspire to try and build the businesses of tomorrow etc…

TandemJeremyFree MemberPosted 12 years ago40 % tax rate are a small minority of top earners. It is 40% not 50% as NI has a ceiling

why should the poor have less money and the rich more?

Is 12 billion not worth having?

stumpyjonFull MemberPosted 12 years agoPersonally I’m more concernd with the current positionning of the 40% tax threshold, or rather the way it is applied unfairly to different households, i.e. one earner on £43k starts paying the 40% rate whilst next door with two earners on £ 42k don’t.

Same but even more pressing issue for households with a single income of £ 20000 vs two wage eaners on £ 10k each.

jonbFree MemberPosted 12 years agoI get the impression the 50% tax was never about revenue and still isn’t. It’s a political tool being used by the two main parties to win votes in the name of “fairness”.

teamhurtmoreFree MemberPosted 12 years agowhat contorted logic says that lower paid people must have wages cut but higher paid people need their taxes cut.

TJ – I appreciate from the NHS thread that economics might not be your strongest subject, but you need to separate the issues here. The logic, far from being contorted, is actually the very basic economic concept of elasticity of supply. Ask yourself, why did New Labour not change the marginal tax rate bands at the start of their time in power. Because even they understood basic economics – at least for a while.

The logic around cutting higher rates of tax lies in the well documented (OECD etc) high labour elasticity of supply that exists among higher earners. So when tax rates fall, the share of revenue generated by top earners rises substantially. You ‘normally’ ask for evidence to support points so apart from the OECD I would point you to the UK experience in the late 1980’s when top rate of tax was cut from 60% to 40%. This change created a large rise in revenues – hence New Labour kept this when they came into power.

This is the ‘logic’ that you talk about. You may address from a different moral argument – but even then the conclusion may not be what you think 😉

brFree MemberPosted 12 years ago40 % tax rate are a small minority of top earners

Eh?

And where did that ‘gem’ come from?

‘Normal’ people pay it now you know.

randomjeremyFree MemberPosted 12 years ago@mashiehood – excellent post sir. People don’t like the uncomfortable truth, which is why your post will likely be ignored or derided unfortunately.

@poly – also agree with you wholeheartedly on the 40% issue – the threshold is set way too low in my opinion.

@tandemjeremy – ?

Personally I’d like to see these progressive tax rates abolished and introduce a flat rate across the board on all earnings, with punitive punishment for evasion and the abolishment of the laws that allow multimillionaires to pay little or no tax in this country.

For those that are frothing at the gash with their TAX THE RICH!!! loonybin politics, read and digest The Tenth Man if it’s too difficult for you to understand why taxing the wealthy at a punitive rate is not a good idea.

TandemJeremyFree MemberPosted 12 years agoBR – its 10% of the top earners only pay 40% ie a small minority

Teamhurtmore – well the treasury believe the 50% rate will bring in 12 billion. There is no evidence for tax cutting increasing revenue, quite the opposite.

TheSouthernYetiFree MemberPosted 12 years agoPoly – are you insane?

What incentive is their for someone on 40k to move up the career progression to 50k when they will barely notice the change in take home pay.

The insentive (by your very own maths) is a net increase in take home pay of about £5k. An extra £100 a week, that’s a decent bottle of red every night if nothing else.

JunkyardFree MemberPosted 12 years agoI would point you to the UK experience in the late 1980’s when top rate of tax was cut from 60% to 40%. This change created a large rise in revenues

can i see the figures0 that prove that each person who has their tax bill cut by 20% ended up payingmore tax as a result of this reduction.

Obvioulsy nothing else happened during this period [ economic boom for example increasing GDP ]that affected tax revenues – I mean footballers for example did not get higher wages so ended up paying more tax as a result for example and would off course have left the country if they tax rate had stayed at 60%.

Odd you dont want to discuss early Thatcher when they did the same – cut taxes *…Why is that exactly? Surely the stats hold up then as well? Was the country not awash with increased money during this – why ever not if the theory is so robust. Your argument is rathe rrosey and cherry picked if you are as well versed in economics as you suggest.TBH the economics can be used either way and it is just down to your morality . Some folk think it is unfair to tax people who earn 150K + per year and others think that this is a fairly sizeable earning which means they can afford the extra burden . However much we tax them they wont be poor. Personally I believe that tax should be used to redistribute wealth/income as I am certain the wealthy wont give it up without legislative action.

* i say cut taxes when obviously I mean reduce direct taxes to the rich and increase the burden on the poor by say reducing income tax and increasing VAT. Can you imagine a tory govt doing that again whilst growth plummets and unemployment grows

polyFree MemberPosted 12 years agoTJ,

Not sure who that was directed at. NI is not completely capped – so someone paying 40% tax is actually paying 42% including NI. Someone paying 50% is paying 52%. Also when you get to £100k income the personal allowance starts to get reduced (and the way it works you pay the higher rate on the reduced amount).

Is it ok to tax people beacuase they are a small minority? That strikes me as populist politics rather than logic: The masses will like this because we sting the “fat cats” and the “fat cats” can’t really do anything about it because there are only a few of them…

However looking at stoner’s graph above it looks like there is more than a “small minority” on 40% tax (taxable pay above £35k). At a rough guess I’d say its 20% of tax payers.

I’m not suggesting you get rid of a 40% rate. I’d even introduce a 30% rate for “mid earners” (someone on £35k ish – whilst I’m sure there will be plenty on here who would disagree, they are the people (and there are lots of them) who the current tax system seems to favour most. Especially if there are two in one household).

uponthedownsFree MemberPosted 12 years agoPoly – are you insane?

What incentive is their for someone on 40k to move up the career progression to 50k when they will barely notice the change in take home pay.

The insentive (by your very own maths) is a net increase in take home pay of about £5k. An extra £100 a week, that’s a decent bottle of red every night if nothing else.

Not really insane. If I managed to get to the next level in my company my working hours and stress levels would increase significantly. Getting 60% of the increase in salary will not make a big enough positive difference in my lifestyle to make up for the loss of personal time promotion would involve. If I was to take home 80% of the increase I might think differently.

TheSouthernYetiFree MemberPosted 12 years agoIf I managed to get to the next level in my company my working hours and stress levels would increase significantly.

I’m going to have to ask for a paycut!

I don’t personally believe that people are motivated by salary alone, moreover are not motivated purely by their take home pay.

I work in a global company which employs people from across the globe in it’s head office within the UK. These are people paying the highest rate of tax who would actually be better off staying in their home countries… they still come here for their careers though!uponthedownsFree MemberPosted 12 years agoIs it ok to tax people beacuase they are a small minority?

That’s what people thought when higher rate tax was introduced as only the super rich paid it. In 1974 only 750,000 people paid it. Currently there are 4 million paying higher rate because incomes have risen faster than the threshold. People should be very cautious when agreeing with any new tax because it may just affect the super rich now but they could well find themselves paying it in the future.

If Osborne is serious about stimulating the economy he needs to cut taxes for all of us. However he would then need to cut public spending even more.

When people quote Mandelson saying. I’m intensely relaxed about people getting filthy rich” They usually don’t give the full quote which ends- “as long as they pay their taxes” Problem is they didn’t even when the highest rate was 40%. They find ways to avoid it. Get rid of the 50% rate- even the 40% rate but close off all the loop holes so millionaires actually pay the same % as the rest of us.

The topic ‘Removing 50p tax rate – seems to be a BBC campaign’ is closed to new replies.