- This topic has 56 replies, 27 voices, and was last updated 12 years ago by Kevevs.

-

Poll Tax – why so angry?

-

rkk01Free MemberPosted 12 years ago

It’s been ages since someone’s quoted Carter in a STW thread.

sign of the times…

rkk01Free MemberPosted 12 years agoRio – you do know that the Poll Tax is not the current system????

druidhFree MemberPosted 12 years agoOne of the other issues at the time was that there hadn’t been a re-valuation of properties for quite a while and one was due. This would have resulted in various discrepancies cropping up and vociferous criticism. When the Poll Tax was replaced by the current system, this had to be done anyway but the new system was “better” so the re-valuation was accepted with little complaint.

JunkyardFree MemberPosted 12 years agoWhen poll tax came in I was a naive lefty

I think you were a confused right winger reading your post.

I hadn’t spotted the big problem, which is that some people just don’t want to pay their share regardless and that’s the basic reason for its unpopularity.

That is a rather skewed view of it and it is perhaps fairer to say they did not want to pay an unfair tax. Introduced twice riots and overthrown by popular revolt /action both times… this happened with other taxes?

Those who think poll tax was unfair conveniently disregard the unfairness and anomolies inherent in the rates system it replaced, where the assumption was that your ability to pay was based on the value of your house.

Are you suggesting it is not true that rich people live in bigger and more expensive houses than poor people…can you evidence that?

So the large family on the breadline who needed a big house got stung for high rates whereas a wealthy single person in a flat paid very little. Little old ladies left in a large house after their family had moved on got stung for high rates even if they only had a pension to live on.

There are fairer ways of eliminating this issue than the poll tax which also meant that the little cleaner of the millionaires house both paid the same

And if you inherited a country estate you were completely stuffed even if you had no money at all.

I can only but imagine what it is like to inherent a country estate and have no money at all 🙄

The current system has an equal number of anomolies, and I haven’t seen any suggestions for any alternatives that I would consider fair regardless of your definition of fairness.

local income tax?

StonerFree MemberPosted 12 years agoEDIT: local income tax is the only proper way of doing it. Why it’s still not politically acceptable I have no idea. Next step though would be a call for tax on assets like the french and we cant be having that! 😛

aha, found some stuff on it.

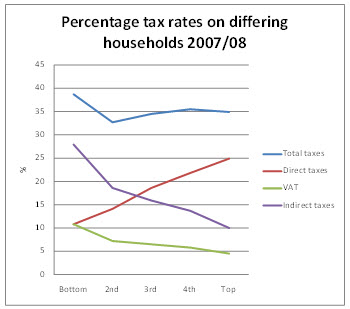

the red line is much like the orange line in my graph.

Green is VAT.

Purple is other indirect tax like alcohol/petrol/fag tax or Council Tax.

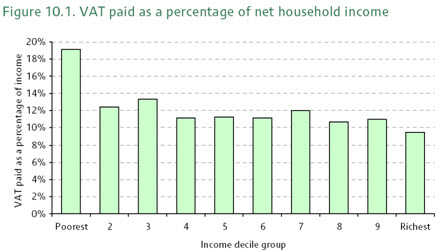

The four data points represent household incomequartilesquintiles.VAT is pretty regressive (not that steeply though, even when you zoom in like the author did), but particularly for the lowest income decile.

good article all told.

Zulu-ElevenFree MemberPosted 12 years agoAre you suggesting it is not true that rich people live in bigger and more expensive houses than poor people…can you evidence that?

Yep – For a while I lived in a tied cottage with my job – which due to its location was worth a fortune with a horrific “ratable value”.

It was a necessary part of the job to live there, and as such the rent was low, but the council tax was frigging laughable for someone on an agricultural wage!

old boy up the road from me was retired, in the estate house he’d lived in for fifty years – value of the house had absolutely no relation whatsoever to his personal worth or income!

JunkyardFree MemberPosted 12 years agoThe switch from direct to indirect taxation [ by mainly Tories but not exclusively] by reducing income tax whilst increasing VAT has switched the burden of tax from the rich to poor. That is changing that have reduce income tax have been [broadly]matched by other taxes and the tax burden overall has not changed much.

ScottCheggFree MemberPosted 12 years agoEven the US won’t allow their citizens to avoid tax through exile…

But it explains why most wealthy Americans bank in the Cayman Islands

RioFull MemberPosted 12 years agoRio – you do know that the Poll Tax is not the current system????

🙄

Council tax is effectively banded and capped rates and I can’t think of any basis that makes it a fair system; it’s a fudge that was introduced when poll tax was removed and if it wasn’t there you wouldn’t invent it.

Are you suggesting it is not true that rich people live in bigger and more expensive houses than poor people…can you evidence that?

I’m suggesting that there’s insufficient correlation between the size of your house and your ability to pay for that to be a fair way of assessing taxes.

One of the problems now with poll tax is that it’s become part of the left wing mantra that poll tax is inherently bad. A correctly implemented poll tax with mechanisms to allow for those who aren’t able to pay would be a lot fairer than what we have now. Maybe local income tax is the answer but it’s hard enough collecting national income tax so I suspect collecting local income tax would be a nightmare.

b1galusFree MemberPosted 12 years agoone of the initial problems with the poll tax, it was illegal to apply different taxation structures in the u.k. and applying it as a trial in Scotland without new legislation basically invalidated the entire process

totalshellFull MemberPosted 12 years agothe poll tax asked those who’d paid little ( large families) to pay more and those alone ( old ladies etc ) to pay less. the loudest voices won.

at the time i was a landlord and as all my tenants could prove they were foreign no one paid!druidhFree MemberPosted 12 years agoOh – and does any recall that the rate of VAT increased from 15% to 17.5% in order to make up the shortfall in revenue when the Poll Tax was replaced?

TandemJeremyFree MemberPosted 12 years agototalshell – actually large families wouldn’t pay more – only two adults.

the real losers were younger folk who shared houses and poor folk with small houses. the real winners were rich folk with big houses – the little old lady with the big house unable to afford rates is a myth – really very rare and benefits were available. used as a piece of propaganda to sell the idea.

One of the most unfair and inequitable taxes ever seen in teh UK

JunkyardFree MemberPosted 12 years agothe poll tax asked those who’d paid little ( large families) to pay more and those alone ( old ladies etc ) to pay less. the loudest voices won.

It did this but as TJ notes it also increased the bills for the less well off whilst generating vast savings for the very wealthy . This was what killed it. The loudest voices were the vast majority of the population who lost out.

KevevsFree MemberPosted 12 years agoeyy! Stoner starting with the graphs and charts already!

Tell me there aren’t people on here advocating the poll tax 🙄JunkyardFree MemberPosted 12 years agonot only are they advocating it you ought to hear why they think people hate it.

The topic ‘Poll Tax – why so angry?’ is closed to new replies.