- This topic has 13 replies, 8 voices, and was last updated 8 years ago by mefty.

-

Peer to peer lending (maybe unofficial)

-

scotroutesFull MemberPosted 8 years ago

I sort of understand the P2P idea and that it offers investors a better return than savings accounts etc. But what about doing it on a 1:1 basis?

Let’s say you lend at somewhere between the borrowers best rate and your best savings rate so it’s a win-win right?

I assume that any interest still has to be declared?

What about getting a legal agreement in place – would the cost of that make it prohibitive?

If it was to purchase a vehicle would it be better for the “lender” to buy it and “rent” it out to the “borrower”?

Just pondering and interested in experiences/pitfalls.

ratherbeintobagoFull MemberPosted 8 years agoI’ve got some money in Ratesetter. You do have to pay tax on any interest and they send me an annual tax certificate.

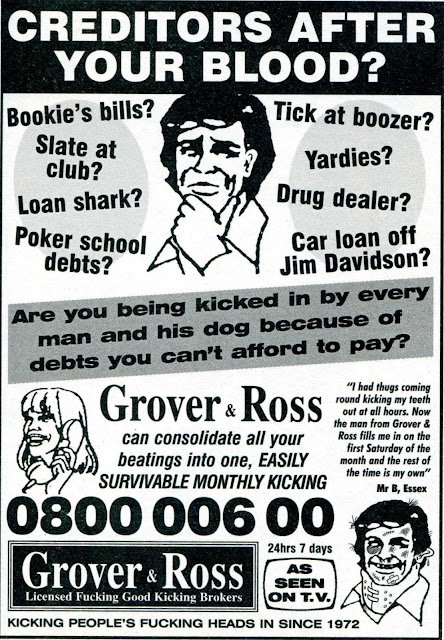

Would you have to have some sort of license for peer-to-peer? Or Jim Davidson?

scandal42Free MemberPosted 8 years agoSurely the security (limited)in p2p lending comes from the fact that they actually lend the money you put in to hundreds of different people. spreading the risk?

What happens when the 1 person you loaned the full amount to can no longer afford to pay their debt due to redundancy or other circumstance?

Sounds very high risk

jam-boFull MemberPosted 8 years agoA long time ago I lent a mate some money. We aren’t mates anymore.

unless you can afford to view it as a gift then I wouldn’t bother.

ratherbeintobagoFull MemberPosted 8 years agoWhat happens when the 1 person you loaned the full amount to can no longer afford to pay their debt due to redundancy or other circumstance?

P-JayFree MemberPosted 8 years agoWhilst of course you can lend money to people if you want to – if you want to charge interest or more importantly what to at least give yourself a chance to enforce repayment you need to be authorized by the FCA – you can apply yourself but you’ll have no chance of passing unless you know what you’re doing – I believe you can employ a consultant to help you pass, expect to pay about £1000 for that. Then you’ll need draft come compliant credit agreements, make a mistake with that and whoever you lend money to can pretty much refuse to repay you and there’s not much you can do about it. Then there’s a lot of compliance to follow in terms of annual statements to provide and CRA reporting.

Fail to do any of those, and probably more that I’ve forgotten about at best your debtors may refuse to pay and there’s not much you can do about it, at worst you’ll be prosecuted as a Loan Shark.

But say you manage to do all that and it’s somehow still profitable to you whilst charging somewhere between savings rates and high street lending rates – underwriting is a tough thing to get right – even the lowest rate providers accept a certain degree of bad debt, it’s all written into their business plan – people lose their jobs, people have mental breakdowns, people just wake up one day and think “I’ve borrowed too much, I owe more than I have assets to cover, I’m going bankrupt” and people die, however well you manage it all those situations will usually result in a loss.

That’s before you even consider your “customer” Sainsburys are offerinf 3.2% APR to customers with excellent profiles at the moment – Nationwide are offering 1.25% on savings – so what are you going to offer 2.2%? Say you lend £10k over 3 years – your return (not including expenses) is £342.79, you would have got £193 from a normal savings account – so you’re £149 up, it’ll take you 3 years to make it back providing your customer repays, in full, on time, every time.

TrimixFree MemberPosted 8 years agoDon’t do it.

If you want to feel better off, just spend less money.

meftyFree MemberPosted 8 years agoThe regulation stuff only really applies to businesses I would be stunned if it is not possible to lend money privately, i.e. not as a business, without being regulated. However, many of the other concerns expressed by other posters are relevant. Whether it makes sense really depends upon how much you are going to earn – businesses still struggle to borrow at sensible rates.

surferFree MemberPosted 8 years agoYou do have to pay tax on any interest and they send me an annual tax certificate.

This has recently changed. You can earn untaxed interest regardless of marginal tax rate from April I think. Google it to see the amount but I think it may be £1k.

P-JayFree MemberPosted 8 years ago@mefty the regulations apply to anyone who wants to make money / interest on it – you can lend your mate £100 or whatever, but you can’t ask him to pay it back plus interest. It might seem a bit ‘big brother’ but those are probably the only laws that stop the loan sharks operating legally.

meftyFree MemberPosted 8 years agoI don’t believe it – it is contrary to all my experience, it would effect a huge number of intercompany transactions, certainly quite a few friends who invest in MBOs etc. Point me to a section that requires this.

P-JayFree MemberPosted 8 years agoIf you’re struggling to sleep you could start here:

https://www.the-fca.org.uk/authorisation-consumer-credit

Inter-company lending isn’t covered as Ltds / Plcs and the few other rare ones are entities in their own right and no subject to consumer credit rules, as for funding MBOs isn’t that usually funded by the sale of shares?

Anyway, going back to the OP’s question to lend people money with interest you need to be regulated.

meftyFree MemberPosted 8 years agoI had already refreshed my memory of that, it applies to firms/businesses not individuals acting in a private capacity on an ad hoc basis.

The topic ‘Peer to peer lending (maybe unofficial)’ is closed to new replies.