- This topic has 14 replies, 12 voices, and was last updated 12 years ago by rootes1.

-

Cycle to work Scheme – Are my employers trying to pull the wool?

-

kayak23Full MemberPosted 12 years ago

I work for a large FE College, with several sites under the ‘umbrella’ of ‘The College’.

I’ve worked here for around 3.5-4 years and in that time have tried and tried to get the Cycle to Work scheme going here or at least find out why they do not run it here.

You would think that a large organisation, particularly one concerned with the education of the current and next generations would want to be seen to encourage such a healthy and sustainable form of transport for its workers, especially at the main site where I work at where we have lots of parking-rage with some mature students saying that they will not re-enrol if parking is not sorted out.

Anyway, my latest little push at my bosses has been through our college Facebook page, asking questions similar to what I have put above(hope I dont get the sack)

Here is the response I got, it really doesn’t sound right to me, about the lack of benefit I mean. Are they making this up to avoid the ‘hassle’ of implementing the scheme?Are they skirting the issue or, if someone knows a lot about the scheme, does this sound about right?

Thanks.druidhFree MemberPosted 12 years agoSince the various changes, the figures seem about right. You’d get a better deal taking your cash into a shop and buying a bike. Given that the shops pay 10% of the value to CycleScheme anyway, there should be some room for manoeuvre on the price…. Either that, or go for a 2011 model that they are trying to punt at a discount.

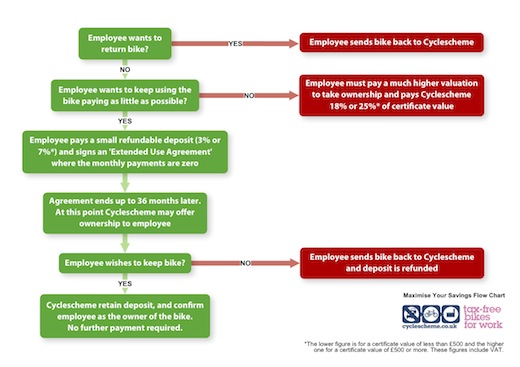

nbtFull MemberPosted 12 years agoIn this example 25% of the original value of the bike must be paid at the end of the scheme, this used to be a “nominal value”

Well they’ve got that wrong for a start. The taxman says they want the tax on 25% of the original value. Your employer doesn’t actually have to charge you anything at all, but many do.

kayak23Full MemberPosted 12 years agoYou’d get a better deal taking you cash into a shop and buying a bike

The beauty of the scheme is that its available to those of us who prefer to, pay as we go… 🙂

mdbFree MemberPosted 12 years agoi am not sure they are trying to “pull the wool” but it is clear they don’t understand their options in terms of how to run the scheme.

The end of scheme payment can be managed in different ways which means that the full cost (eg the 25% they quote) does not have to be bourne by you and therefore the savings can still be 30% – 40%.

Regarding VAT their understanding is incorrect. The scheme is now covered by VAT, which means your monthly salary payments are VAT-able and therefore the college is no worse off.

It sounds like they are looking into it so when they talk to a supplier they should get more advice.

gonefishinFree MemberPosted 12 years agoSeems odd to me. The numbers that my company list show the net cost of a £500 bike to be £283 for a basic rate taxpayer and £242 for a 40% taxpayer, although that is for the 2011 scheme so it may not cover any recent changes. The rental period for my company is however 3 years (salary payment for one) so the value at the end of the time will be much less.

portlyoneFull MemberPosted 12 years agoA large part of the reason our place stopped doing it was resourcing costs. The tax thing was a more sellable excuse.

40mpgFull MemberPosted 12 years agoAs NBT says. Even so, the scheme isn’t as good value as it originally was. Ours is run by Wheelies in Cardiff, max spend is £1,000 and although they have quite an extensive range, it doesn’t cover some of the ‘value’ manufacturers like on-one or Ribble.

I got a Giant Trance X4 before the rules changed and was worried about having to stump up a larger final payment, but a year or so later the company haven’t asked for any more – so I guess I fall into the beneficial use / extended loan bracket or summink.

If your college use an external supplier I don’t think it will cost them anything, the supplier take a small cut for admin and use it as a way to get additional sales.

At the end of the day though, you can often find the bike you want cheaper in sales than buying/hiring through the scheme.

franksinatraFull MemberPosted 12 years agoThey are both right and wrong. There are three options for end of scheme. What they describe is just one. The now usual option is to extend the hire period through the scheme provider to 3 year. No liability to the college and the three years results inthe bike being worthless.

If they want to do the scheme, the benefits are there. If they don’t they canfind lots of good excuses.

I would ask Cyclescheme or another provider to get in touch with them to clear things up

polyFree MemberPosted 12 years agoWhilst I can understand why an employee who can’t tap into this benefit might be frustrated, the value of the scheme is somewhat diluted. Nobody gets the VAT benefit now, but a FE College would never have received it. I’d also guess that there are a lot of 20% tax payers in an FE College rather than 40% ones, they benefit less. The ‘end value’ issue just makes it too complicated for some people to consider, I’d guess the college won’t want the admin hassle of having different options and so the ‘safe option’ for them is to revert to 25% of purchase price. One thing most employers don’t seem to have realised is they don’t need to charge you the full price of the bike in the 19 months. So, e.g. if they are going with 25% value at the end they could just recover 75% through salary sacrafice during the 12 months of the ‘lease’.

I can understand why they might think its not worth the bother.

Certainly if they were really keen to encourage cycling (rather than providing an outlet for high tax payers to dodge some tax on a bike they would probably have bought anyway, and will rarely ride to work) there are probably better ways – good safe, dry bike storage, access to showers, facilities for storing or even washing kit when it gets soaked in winter etc.

DibbsFree MemberPosted 12 years agoThe now usual option is to extend the hire period through the scheme provider to 3 year. No liability to the college and the three years results inthe bike being worthless.

Not according to my understanding of EIM21667a, I still make it 8 or 12% depending on the initial value of the bike.

kayak23Full MemberPosted 12 years agoLike everything like this, it seems to be pretty complicated to grasp. Thats my take on it anyway, though I am really not a numbers person granted.

I have friends who have very recently taken advantage of the scheme at the companies they work for and it seems to work very well for them. Whether its different due to who they work for I don’t know but its frustrating not to be able to take advantage, particularly as I am always on a bike of some description…

nbtFull MemberPosted 12 years agocan we all please remember that Cyclescheme are a *FOR-PROFIT* company who operate a version of the government’s cycle-to-work scheme. You don’t *have* to use them, but if you do then they will take 10% of the purchase price from your chosen shop. You can buy direct, and the shop will make more profit, perhaps allowing you to negotiate a small saving. This means that at the end of the 12 months, your employer doesn’t have to return the bike to cyclescheme, they can let you keep hold of it. If your employer retains ownership, your tax liability is reduced. If your employer sells or gives you the bike, you are liable to pay the tax on 25% of the bike’s original selling price

rootes1Full MemberPosted 12 years agoWell they’ve got that wrong for a start. The taxman says they want the tax on 25% of the original value. Your employer doesn’t actually have to charge you anything at all, but many do.

They could also give you the bike and then declare the 25% (of any other defend able value) as a benefit in kind and then you would just pay tax on that value (which is less than than just paying the 25%)

or extend the hire agreement period until the bike is completely devalued…

The topic ‘Cycle to work Scheme – Are my employers trying to pull the wool?’ is closed to new replies.