- This topic has 188 replies, 96 voices, and was last updated 6 years ago by amedias.

-

Consumer debt averages £13,000 per household

-

convertFull MemberPosted 6 years ago

If you grew up with paying for tuition ( when you earn enough ), expensive rents and high property prices, then how does getting into debt actually help you with any of the above ? Is it a case of saying I owe £40000 in tuition fees, what is another couple of thousand on top of that, or is there an element of impatience and entitlement “I’ll buy it on credit because I want it now and I deserve it ” ?

You are missing the point that (I think) was being made. There are copious young households who fall into this £13K debt bracket before they have done a (professional) days work. I think people of my generation and older think of people who rack up debt as either doing it with frivolous n+1 style purchases or not managing to balance incoming and outgoing sufficiently – i.e. their fault. There is a generation that drop straight into this category day one of being a proper adult before they have had time to make any errors doing something that society thinks is laudable (furthering their education).

nickfrogFree MemberPosted 6 years agoIt has little to do with generation but with luck – if you are, say 40 to 55

years old today, you’ve probably surfed some very very good years (1996-2008 and to some extent 2011-2016) which have put you in a very positive asset situation, so your perspective is a little distorted when talking about “the youth of today” who simply won’t get access to those assets that easily/quickly.g5604Free MemberPosted 6 years agoIf you grew up with paying for tuition ( when you earn enough ), expensive rents and high property prices, then how does getting into debt actually help you with any of the above ?

Really!? maybe because you have no money, because of all of the above.

cranberryFree MemberPosted 6 years agoIf renting where you are is too expensive – move to Middlesbrough – you can get a flat share for £55 per week.

Houses there, and elsewhere in the less fashionable parts of the north, can be found cheap. It might be that you *want* to live somewhere expensive, but we can’t always get what we want.

I appreciate that there are quite a few people that have been mis-sold a university education by an industry rather more interested in itself rather than outcomes for its customers and consequently have consequential debts without great jobs to pay them back, but you can live cheaply in parts of the UK if you

want toif your budget mandates it.At the end of the day, buying anything on interest bearing credit is stealing from your own future.

EDIT:

When I was straight out of university back in <mumble> I took a temporary contract in another city, I’d been used to the lifestyle that my parents had and didn’t want to live anywhere too shabby and ended up working for a year only to pay bills and almost break-even. It was a lesson in budgeting and ensuring that my cost of living is lower than income – you cut your cloth to suit your purse.

kerleyFree MemberPosted 6 years agoAt the end of the day, buying anything on interest bearing credit is stealing from your own future.

Or from another angle, it is bringing the future to you now.

Tell me why I should save up for a year to have something that I could have now on a 1 year credit deal as I am not understanding the anti credit logic on this thread.

Whatever it was I wanted to buy I will have had the use of for a year more than you. Only I can say whether that extra year of use was worth it.nickfrogFree MemberPosted 6 years agoToo much binary thinking. Not enough critical thinking.

A mortgage is a very virtuous thing. Not having a mortgage doesn’t mean you don’t have liquidity for a rainy day – actually NOT having a mortgage might actually mean that you don’t have liquidity.

Spend a little, save a little.

convertFull MemberPosted 6 years agoWhatever it was I wanted to buy I will have had the use of for a year more than you. Only I can say whether that extra year of use was worth it.

I guess it depends if the object in question has a finite life. For most objects it is not an extra year’s use, it’s having it a year early and paying whatever the fee for the credit was as a payment. I agree though that it can make sense when the fee is low (or nil) or getting the object now is worth it in other ways. If you have to have a car to get to work* and your old one is beyond repair or costing a fortune to keep on the road having the car today would make sense if the alternative was not being able to work. Taking the loan to buy a prettier or nicer car when the current one will do fine probably doesn’t.

* – I appreciate that ‘have’ and ‘car’ and ‘work’ are emotive words when in the same sentence. I started a thread about it a week or two ago.

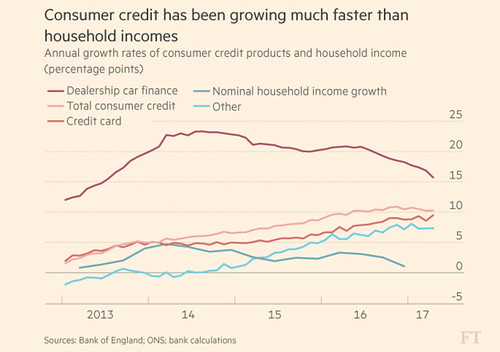

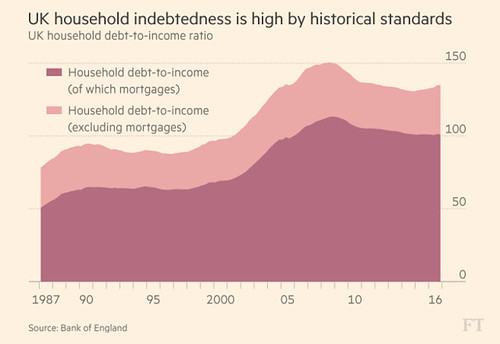

footflapsFull MemberPosted 6 years agofrom the BoE (via FT):

Source doc here

[url=https://flic.kr/p/UZd8hM]Consumer Credit Growth[/url] by Ben Freeman, on Flickr

[url=https://flic.kr/p/W2cPzk]UK indebtedness[/url] by Ben Freeman, on Flickr

Ben_HFull MemberPosted 6 years agoThe example often used is something along the lines of: “why delay having a certain thing by a year, when I can have it now?”.

The answer is more than just simply any benefits of a “delayed” purchase (which obviously include no costs of finance that will be present even if hiding behind the attractive “0%” tag).

In fact, you may decide over time not to actually buy said thing at all – which will make you better off. Such a decision would instantly increase your independence and means.

Delaying and / or not purchasing non-essential things will have a very big cumulative impact on your finances in the medium and long term.

yourguitarheroFree MemberPosted 6 years agoFor me that one is about the unexpected.

What if you sign up to the agreement, then you lose your job or something.

And if its something you won’t get a lot of money back selling (say, a TV) and you’ve done this for a few items then it can suddenly be a problem.I’m not saying i’m right and you’re wrong or anything. Just my approach.

igmFull MemberPosted 6 years agoHouses there, and elsewhere in the less fashionable parts of the north, can be found cheap. It might be that you *want* to live somewhere expensive, but we can’t always get what we want.

You can find somewhere cheap, but can you find a decent income? Reducing outgoings may help, but not if it harms income overly.

It is the ratio of income to outgoings that matters not the absolute level of either.

See also reducing the deficit / national debt.mudsharkFree MemberPosted 6 years agoWhat a lot of people don’t understand is the concepts of Net Present Value and Internal Rate of Return – maybe makes this compounding interest thing clear. Once understood the decision of when to borrow to get something early becomes far easier. If taken to an extreme though you’d never buy anything except essentials as you’d see how much not spending £2k on a bike now would impact you in, say, 30 years time when you retire.

matt_outandaboutFull MemberPosted 6 years agoYou can find somewhere cheap, but can you find a decent income?

I firmly believe that a *lot* of issues in the UK could be improved by evening out the north/south divide, with Westminster actually focussing on how to spread further north.

nickfrog – Member

It has little to do with generation but with luck – if you are, say 40 to 55

years old today, you’ve probably surfed some very very good years (1996-2008 and to some extent 2011-2016) which have put you in a very positive asset situation, so your perspective is a little distorted when talking about “the youth of today” who simply won’t get access to those assets that easily/quickly.I think there is a lot in this. As I mentioned before, it seems many are ‘set up’ in many ways through either direct support from parents or through benefiting the rise in house value / income / etc through the ’90s and early 2000’s. This can be small things – like being given house deposit, or given a car etc, but which over a decade or two add up.

We have some of our family who have never paid any childcare (for three kids), have been given the cast-off three year old cars from grandparents, never had to pay for a holiday (in-laws own a place in Madeira) and the kids are often sporting many a toy/new clothes/day out from the in-laws generosity. This leaves them many hundreds of pounds a month better off, multiplied over 15 years of their marriage…

I think that todays ‘youth’ (below mid-30’s!) have not got that slow increase in wealth going on. The middle and upper classes *do* have that grandparents wealth staring at them for an inheritance at some point. Some of the others in our family are openly talking about debt not being a problem, because it will all magically be sorted when granny dies…

That said, there are also a lot of hardworking and good-decision making folk around, who then surfed that increase of house prices and wages well, and are now benefiting from it.

If only I hadn’t had a business go pop as the global financial crisis loomed… 😥

ourmaninthenorthFull MemberPosted 6 years ago@ Footflaps – I came to the thread to say the same (only I’d read it in the paper copy, so wouldn;t have had neat links).

What’s interesting is the apparent conflict between the banks being asked to strengthen their balance sheets and the fairly open arguments among the members of the MPC about whether or not to raise rates.

Raising rates will help manage inflation (esp as it’s largely externally driven due to the value of sterling) but I can see the credit card and car loan bubble shrinking much faster as a result. Plus, with wage inflation not happening, increased rates will have an additional impact on the wider economy.

Hmm. I’ve largely missed the benefits of the asset boom (house price aside) and am about to extend my mortgage to renovate the house. I don’t think I’ve quite got the hang of this..!

johndohFree MemberPosted 6 years agoI firmly believe that a *lot* of issues in the UK could be improved by evening out the north/south divide, with Westminster actually focussing on how to spread further north.

But then the ‘really cheap housing’ in Middlesbrough will no longer be really cheap. There isn’t a perfect solution here and from all of the posts I have read, it seems most of us have reached a point where things kinda work for us given our circumstances.

Gary_MFree MemberPosted 6 years agoI find it funny that there are people saying ‘I don’t have any debt, well apart from the mortgage’ – that’s something you need to pay back so it’s a debt.

Debt free to me means no mortgage, no credit cards, no car loans, no overdraft, etc.

jam-boFull MemberPosted 6 years agoI think we established right at the start, secured debt and unsecured debt are very different things.

footflapsFull MemberPosted 6 years agoI find it funny that there are people saying ‘I don’t have any debt, well apart from the mortgage’ – that’s something you need to pay back so it’s a debt.

Although it’s normally secured against an appreciating asset which you would need anyway (else you’d have to rent) so pretty different to most other consumer debts.

Plus, in most case repayments are less than or equivalent to the rent, so a mortgage can be cheaper than renting.

nickfrogFree MemberPosted 6 years agoYes. Mortgage = good debt as the asset is extremely likely to grow in value long term and you can even use it to sleep in or to generate an income which is a multiple of (at least current) interest rates at the same time.

matt_outandaboutFull MemberPosted 6 years agoBut then the ‘really cheap housing’ in Middlesbrough will no longer be really cheap.

But then London village will not be so over-expensive either.

More importantly, public services will be under less pressure, investment will also flow out to all regions, instead of constantly favouring south east.

Our environment will be also under less pressure, our transport systems can be re-built to favour all travel, not just southwards…It is a long path, but one I think that would work…

matt_outandaboutFull MemberPosted 6 years agoMortgage = good debt as the asset is extremely likely to grow in value long term

Tell me this one again? Why should house prices grow? I bought a flat in 2009 (yes, I know). It is still @-20% down on value and sliding more…

footflapsFull MemberPosted 6 years agoTell me this one again? Why should house prices grow? I bought a flat in 2009 (yes, I know). It is still @-20% down on value and sliding more…

A statistical outlier….

Gary_MFree MemberPosted 6 years agoGood debt, bad debt, you’re not debt free if you have a mortgage.

johndohFree MemberPosted 6 years agoGood debt, bad debt, you’re not debt free if you have a mortgage.

No you’re not, but for most people they have an asset which has a higher value than the debt which is different than getting a £20k loan for the latest Ford Focus.

kerleyFree MemberPosted 6 years agoSo getting a loan for a 1970’s 911 is good debt, getting a loan for a 2017 911 is bad debt

nickfrogFree MemberPosted 6 years agoMortgage = good debt as the asset is extremely likely to grow in value long term

Tell me this one again? Why should house prices grow? I bought a flat in 2009 (yes, I know). It is still @-20% down on value and sliding more…

I did say extremely likely, not 100% guaranteed. Past performance is not necessarily an indicator of future growth of course but think of a property asset over a longer period like 20/30/40 years and look at the average growth rate. It’s basic balance of supply/demand economics BUT with lower immigration, people leaving and if a brutal relaxing of planning laws were to happen, that balance may well change. It’s also possible you bought badly or were very unlucky as not many properties are still in the red compared to 2007, let alone 2009. Where is it ?

mudsharkFree MemberPosted 6 years agoI imagine some of those Nottingham 1 bedders aren’t doing so well.

I’m debt free and could probably stop working, certainly if I moved to a cheaper area/downsized, but I like where I live, and would get bored anyway, so carry on whilst I can still earn a decent amount.

5labFull MemberPosted 6 years agoNo you’re not, but for most people they have an asset which has a higher value than the debt which is different than getting a £20k loan for the latest Ford Focus.

but if you pay £20k cash for a focus when you have >20k left on your house, you could have put the money on your house instead. Yes, the lending is secured, and therefore cheaper, but you’re effectively still borrowing 20k for a car (and, worse than a car loan, you can lose your house if you don’t pay it..)

amediasFree MemberPosted 6 years agoSome of the others in our family are openly talking about debt not being a problem, because it will all magically be sorted when granny dies

And what will they do if granny leaves them nothing due to care costs/dementia fuelled spending spree/tax/falling out etc. ?

When my parents die I’ll probably inherit a house, but I’m not planning my future around it, it’s a big gamble for anyone to take, and I’d honestly rather I didn’t inherit any money from them.

I’ve openly told them if they leave me any actual money (cash/savings) at all I’ll be disappointed as I firmly believe they should spend any money they have* enjoying themselves, I’d trade any lump sum they could leave me for seeing them enjoy their last years. They’ve already helped me and my wife out by helping us with deposit to buy a house together, their job in supporting/setting up their child is well and truly done in my eyes.

In terms of OP though, we have a mortgage and student loans, no other debts at all and we try to live within our means and normally manage to save something each month for future purchases/rainy day.

I understand perfectly well how to make use of finance, 0% deals, and how it could enable me to buy things, but I just don’t like borrowing money at all and sleep better knowing I don’t owe anything other than for the house (which is a better situation than renting), it’s the only real debt I’m comfortable having, I don’t begrudge other people for acting differently, but it’s not for me if I can help it.

* to clarify, their retirement income is well in excess of the combined (full-time) income of my wife and I, they’re in a better position now in retirement than I imagine we ever will be, I still want them to spend it on themselves not leave it to us.

The topic ‘Consumer debt averages £13,000 per household’ is closed to new replies.