- This topic has 212 replies, 5 voices, and was last updated 5 years ago by sadexpunk.

-

any financial (pension) advisors in?

-

sadexpunkFull MemberPosted 5 years ago

Open a new SIPP for your missus. She can add to it as and when.

Re yr wife make sure shes maxed out her state entitlement and bought back her gap years. Its far better value than any private non employer subsidised pension.

thats done now, her HL SIPP has got her couple of grand in for what its worth. as shes self employed now i just did thst gateway thing to look at her state pension projection. it states much the same as mine that the forecast is the most that she can ever get, so no opportunity for buy-back. its £164 p/w, so £8,500 pa. there were a couple of gap years in 94 and 96 i think but it states that all she has to do is pay NI contributions for another 8 years before 2041 and she’ll get that max.

silly question but does that really mean that in 8 years time at age 51 she can stop paying NI altogether and would still get the max possible for her?

thanks

footflapsFull MemberPosted 5 years agosilly question but does that really mean that in 8 years time at age 51 she can stop paying NI altogether and would still get the max possible for her?

only by not working!

We all pay NI until our official retirement date after which they don’t currently levy NI, although they are talking about bringing it in to cover social care costs…

Once she’s hit the 35 years, there’s no state pension benefit to working any more, but obviously if you don’t work, you don’t get paid either….

sadexpunkFull MemberPosted 5 years agoso if you work you have to pay it? i thought it was ‘a good idea’ to pay it if you were self employed, your choice rather than obligatory and if you didnt you wouldnt get full pension. shows what i know eh? 🙂

footflapsFull MemberPosted 5 years agoNot sure about self employed, but if you’re PAYE, you have no choice until you hit retirement date.

rene59Free MemberPosted 5 years agoOnce she’s hit the 35 years, there’s no state pension benefit to working any more, but obviously if you don’t work, you don’t get paid either….

The 35 qualifying years thing is too risky to bet on if you are still someway from retirement age. I can see it getting bumped up to 40 just in time to catch a few people out.

poolmanFree MemberPosted 5 years agoYes i have 2 qualifying years to go till maxed out but am holding back as if I work again i have to pay anyway, for no extra benefit On the flip side, the price is always going up. I think the price of a qualifying year has doubled over the last 10 years.

To be brutally honest the state pension has all the characteristics of a ponzi scheme, but you would be a fool to not contribute.

My latest dc review quoted a price of 50k for 1k of indexed pension, certainly makes the state pension look good value.

footflapsFull MemberPosted 5 years agoTo be brutally honest the state pension has all the characteristics of a ponzi scheme, but you would be a fool to not contribute.

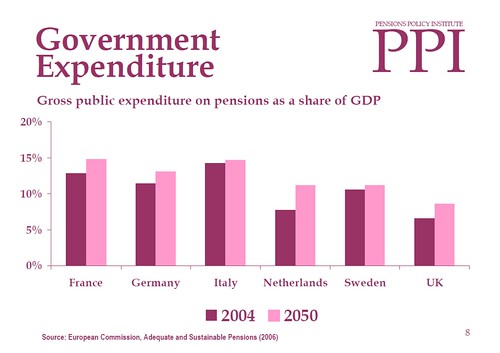

Not really, it will cost more in future, due to ageing population, but not massively more based on current forecasts. The bigger issue is probably long term care costs, which are going to rise and no one is talking about funding for it….

[url=https://flic.kr/p/25MSi67]Pension affordability[/url] by Ben Freeman, on Flickr

dantsw13Full MemberPosted 5 years agoHey SadexP – hows your HL SIPP doing? My fund has ridden the stock market plunges of early this year to still be up yr on yr so hopefully you are ok.

sadexpunkFull MemberPosted 5 years agoHey SadexP – hows your HL SIPP doing? My fund has ridden the stock market plunges of early this year to still be up yr on yr so hopefully you are ok.

well i wont profess to understand the figures at all, but i logged in to see if i could twig anything that may make sense to you 🙂

is it cost vs value reading? it seems to imply that across the 5 things ive invested in, its total cost £82,795 and value now is £87,220. i think it also says that its a £4,425 gain which is 5.34%. that sound about right?

thanks

sadexpunkFull MemberPosted 5 years agowell this seems to be dragging on, not sure whether its HL or a company called JLT who keep messing up, but ive been trying to get my small DC pension (no4) transferred over and its still not happening…..

3. a DB pension from engineering job no 2, 10 years worth of payments doing nowt special.<em class=”bbcode-em”>unknown value, says it should pay £5,400 per annum

4. a small friends life/provident pot from some AVCs at the time of pension 3. <em class=”bbcode-em”>current value £2000

the problem is, JLT seem to manage both of these pots, and they keep sending transfer paperwork over for me to sign for no3 instead of no4. i ring em, they say its HL fault, HL say JLT arent getting back to them when they request the right policy, its annoying not being able to close this all off.

ive just had more paperwork through for the wrong policy today. but…… whilst just checking it is in fact wrong, its got me questioning it again, so id like to ask your thoughts.

i believe no3 is a DB pension, the bumph says itll pay me £5,800 per year now at age 65 (originally said £5400). yet the transfer value is £136,000.

lets round everything up, and call it £6000, at age 65. 20 years worth of that takes me to age 85 and be £120,000.

if i took the (rounded up figure of) £140,000 and invested it (yes investments can go up or down) but is it not a decent shout to invest this also with HL instead? if i took the same £6000 pa thatd take me to age 88 assuming no growth.

have i got my sums right? do you think its worth transferring or would you still say stick with the DB as its a known quantity for life?

thanks

EDIT: also i think im right in saying if i keep the DB annual payment, if i die my wife would just get half annually yep? yet chuck it into the SIPP and its all hers still?

footflapsFull MemberPosted 5 years agoi believe no3 is a DB pension, the bumph says itll pay me £5,800 per year now at age 65 (originally said £5400). yet the transfer value is £136,000.

If it’s DB then leave it well alone, you’ll struggle to better the guaranteed figure.

poolmanFree MemberPosted 5 years agoSadx – yes dont sell your db for that its only c 25 x the benefit. I have some db which apparently is offering 40x and I still wouldn’t sell. I may have done if I was in poor health but that’s the only reason. Keep it and enjoy a stress free retirement.

The topic ‘any financial (pension) advisors in?’ is closed to new replies.