- This topic has 88 replies, 38 voices, and was last updated 8 years ago by monkeycmonkeydo.

-

50k to invest.Self invest or advise ?

-

meftyFree MemberPosted 8 years ago

I also know a lot of advisers whether IFA or bank based don’t understand about funds and their behaviour, so if these guys who do it every day don’t really get it, how would the average man in the street claim to understand it.

Which begs the question, why pay 0.5% if many of them are incapable and how easy is it to find one who isn’t? The ones I have met have been pretty unimpressive.

I have less of a downer that you on trackers, I think very few people consistently time the market, you hear alot about superstar fund manager’s successes but not their failures – it is a bit like hedge funds – you hear about the super successful ones but hardly anyone mentions the many that get wound up each year.

footflapsFull MemberPosted 8 years agoFunds, shares etc are all a massive punt in a complex and rigged game.

Not really, long term (10+ years) they have always done very well and will almost certainly continue to do so. As long as you don’t mind the short term ups and downs and accept that every few years there will be a big correction.

thecaptainFree MemberPosted 8 years agoThat’s a crazy charge joeegg. You really are better just doing it yourself. It’s not as if the charges actually get you anything in terms of performance, let alone performance guarantees.

footflapsFull MemberPosted 8 years agoGood article on shares vs cash vs property:

FWIW >95% of my savings are in stocks and shares, it’s my pension, so I only care about it’s value in 20+ years time.

StonerFree MemberPosted 8 years agoWhat mefty said.

I wouldn’t trust an IFA to time a boiled egg properly let alone trade out volatility across a fund.

Long term tracker exposure excl distorted markets like the 100 are a reasonable position to take for non-geographic diversity.

monkeycmonkeydoFree MemberPosted 8 years agoCF Woodford Equity income.

Jupiter European opportunities.

RIT Capital Partners.

Baillie Gifford Shin Nippon.

And a bit of money in Gold,cash and peer to peer lending.

Tick the dividend reinvestment box,light a cigar put your feet up and WAIT…….Do not panic in market downturns.NeiljulzmFree MemberPosted 8 years agoMost IFAs now outsource their fund picking to fund manager risk managed multi asset funds. Too detailed to go into here but put very simply if a funds holds enough different assets then they should be enough difference in correlation to smooth out big moves in one asset class against another.

Most advisers don’t sell their services based on fund picking but more on selection of the best product for your needs, tax situation etc. Essentially they sell their professional knowledge much like a solicitor or accountant.

There are also smoothed funds out there who give a predicted growth rate and average out the returns to wipe out short term volatility but you can’t buy these types of funds without an adviser.

Best way to find a good adviser is a recommendation.

meftyFree MemberPosted 8 years agohere are also smoothed funds out there who give a predicted growth rate and average out the returns to wipe out short term volatility but you can’t buy these types of funds without an adviser.

Endowments promised that too, unfortunately the promise didn’t pay of the mortgage.

surferFree MemberPosted 8 years agopeer to peer lending.

Remember you will pay tax at your marginal rate. but from April you will be able to put them into an ISA. I have invested a bit in the past but beware of bad debts which even on a spread portfolio drag your profits down from the headline pa rates.

joeeggFree MemberPosted 8 years agoThanks Neil.

The Woodford fund is one that i had already looked at and had in mind.I’ve also got a Jupiter Merlin Accumulation fund.

I’m drawn to the Fundsmith Accum Isa Fund.Seems a pretty basic philosophy.

I could carry on researching for months to come and become further away from a decision.trail_ratFree MemberPosted 8 years ago“Funds, shares etc are all a massive punt in a complex and rigged game.”

And you believe classic cars and property are a better bet…..

your not one of these IFAs they are talking about with boiling eggs above are you?

monkeycmonkeydoFree MemberPosted 8 years agoPerhaps if your feeling really adventurous you could purchase a bitcoin.It seems some of the banks are looking into the matter.

brooessFree MemberPosted 8 years ago+1 for getting rid of any debt you have – it may well be costing you more than any gain you’d get from investing…

In terms of trackers – as Stoner says, think beyond FTSE 100 – there’s more than a few oil, gas, mining companies and banks in there… which under current circumstances may or may not prove to be good long term investments

bear-ukFree MemberPosted 8 years agoI’m having a bit of fun with Peer to peer lending. Joined the Moneything and so far I part own a few supercars and a few building developments. 11K invested with a return of 1K interest. Its more fun than watching my Stocks and shares ISA’s losing money.

Another safe option is Santander 123 account. Up to 20K with 3% interest.monkeycmonkeydoFree MemberPosted 8 years agoI would avoid VCTs and buy to let.The latter being a bubble ready to burst.Plus I couldn’t be arsed dealing with tenants.

5labFull MemberPosted 8 years agoGood article on shares vs cash vs property:

I’d disagree. They’re comparing stocks with the dividend re-invested to property, without counting any of the costs/benefits of owning the latter. For example, if you buy a house outright, it has a utility (you can live in it, or rent it out to someone else), which normally outweighs the costs (although they are much more significant than any 1% fund manager fee).

monkeycmonkeydoFree MemberPosted 8 years agoArticle seems to make clear, that over the long term S&S are the biggest winner(As long as you reinvest any dividends).Also,the Treasury is on to the buy to let brigade.With increasing regulation,taxes and stamp duty.Looking at the state of Britain’s economy this will only increase.Personally,I’d rather lose a percentage or two of income and avoid dealing with tenants/greedy lettings agents.

monkeycmonkeydoFree MemberPosted 8 years agoFantombiker,could you provide us with some evidence about the stock market being rigged.I would like to see it.

5labFull MemberPosted 8 years agoArticle seems to make clear, that over the long term S&S are the biggest winner(As long as you reinvest any dividends).Also,the Treasury is on to the buy to let brigade.With increasing regulation,taxes and stamp duty.Looking at the state of Britain’s economy this will only increase.Personally,I’d rather lose a percentage or two of income and avoid dealing with tenants/greedy lettings agents.

going forwards, I’d tend to agree, BTL is clearly a target of sorts, and its certainly more risky than a balanced stock portfolio (ie a tracker fund).

However, that article claims to see how popular asset classes performed over the last 20 years. if you invested 100k in 1986 in property, you could either have bought one house and rented it out, generating an additional income of approx £324k (assuming rents rise an average of 2% per year, and the initial yeild was 8%, but not assuming re-investment of that income in anything), or you could have bought 25% of 4 houses (each worth £100k then), have the mortgage interest paid off by the rent (it’d probably actually generate a tonne of money on the side, if you started in 1996, but lets not get into that), and you’d now have £320k outstanding mortgage against a value of just over £2mm, or £1.68mm return (1680% return by my numbers, or an annualised return of around 28%). Which is way, way more than any stocks.

Of course, those sorts of returns are possible due to leveraging, which is inherently risky. If you gambled the stock market with a large sum of borrowed money, you could also get large returns, but unlike property no-one will lend you the money to do that (you can kind of do it by shorting stocks, but thats risky too).

nickjbFree MemberPosted 8 years agoThat article does seem to just be talking about property values only. That’s not generally how you make money good from property ad an investor. Mortgaging against btl properly is risky and the banks say they are looking at it but the returns are hard to argue with and even with a few percent extra taxes it’s still right up there.

US graph, but UK one in telegraph a few weeks back was a similar shape but I can’t find it.

monkeycmonkeydoFree MemberPosted 8 years ago5lab-getting hold of money to invest in shares is easy enough.Most platforms offer you credit for a Kickoff.Individual retail investors,however,should avoid borrowing to invest.

monkeycmonkeydoFree MemberPosted 8 years agoI would avoid ETFs as well.With the introduction of Leveraged ETFs and ETFs designed as shorts I think we have another out of control bubble ready to pop.As if we needed any more.

footflapsFull MemberPosted 8 years agoI would avoid ETFs as well.

do tell….

I just put a load into a Gold ETF (hedged GBP) as a bit of an insurance policy in case the market crashes again.

monkeycmonkeydoFree MemberPosted 8 years agoThere are questioned being raised about the liquidity of many ETFs.Will you be able to sell in a market panic and who exactly will be the buyers.Also,with the introduction if leveraged ETF’s,how stable will they be in future?They may multiply gains in a rising market but will people be able to pay there debts in a falling market.We’ve been here before footflaps.

BillMCFull MemberPosted 8 years agoManage your own portfolio in £5k chunks. Possibly combine funds with shares. I got out of funds and main market shares and now focus on the AIM market. It’s volatile but very engaging. Check out the 150 funds listed by HL. I also have been underwhelmed by IFAs…if they were any good why are they still working? You can check where funds are investing and then do it yourself, cut out the IFA and the fund manager. Read Robbie Burns’ book The Naked Trader, an excellent introduction to the markets.

trail_ratFree MemberPosted 8 years agothose saying throw money at your pension get the tax breaks might want to read up on pension tax changes at the end ….. its not all gravy by any means and to me it just seems like your tying up your money in an ever changing goal posts system ……

Im not saying dont have one – i have one a company one and i put in the minimum ammount to get the maximum company contribution how ever im alot less happy about it once i read the small print and read that currently despite the changes in the rules – i can only take an anunity from (mercer) and i cannot draw down or other such method …..

currently – this may change but its not all the bed of roses the government paints as a huge tax loophole – what is the saying about death and taxes – and nothing being surer 😉

footflapsFull MemberPosted 8 years agoi can only take an anunity from (mercer) and i cannot draw down or other such method …..

But you can almost certainly transfer out to a provider who does offer different options.

Also, annuities aren’t that bad, they do offer a guaranteed income, which no other option does.

surferFree MemberPosted 8 years agoi have one a company one and i put in the minimum ammount to get the maximum company contribution

This. it is a position that many people dream of but my pensions will pay enough to attract tax when I take them, hopefully around 60-62.

I have ISA’s which will be a major income for me in 20 years hopefully, and I plan to take some money out of my pension at 55 to max my ISA usage for the remaining years and shield as much from tax as I can.kcalFull MemberPosted 8 years agoI tend to shy away from individual bets – even ETF gold stocks – and look at contra trusts like Personal Assets Trust. Others in a similar vein exist – I see RIT Capital Partners above, others to look are CF Ruffer IT – I do like newsletter approach as they may be wrong but prepared to argue the toss and explain *why* ( even to point of admitting wrong-ness).

DobboFull MemberPosted 8 years agomonkeycmonkeydo

Tick the dividend reinvestment box,light a cigar put your feet up and WAIT…….Do not panic in market downturns.

footflaps

long term (10+ years) they have always done very well and will almost certainly continue to do so. As long as you don’t mind the short term ups and downs and accept that every few years there will be a big correction.

These +1

It’s time in the market not timing the market as the old saying goes.

Funds I like that have been mentioned:-

CF Woodford Equity income.

Jupiter European opportunities.

Fundsmith.And a FTSE 250 & Global AS trackers if you like.

Others include:-

Fidelity UK Smaller Companies

Fidelity Special Values (Investment Trust)Plus low volatile funds such as:-

Henderson UK Absolute Return

Threadneedle UK Absolute AlphaDon’t go for way out there off the wall funds and shares. Good luck. 8)

footflapsFull MemberPosted 8 years agoIt’s time in the market not timing the market as the old saying goes.

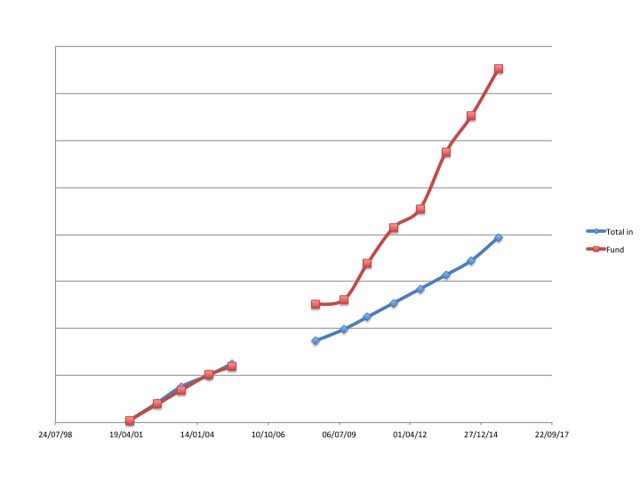

Yep, I plotted out my work pension the other day (couldn’t find a couple of annual summaries):

First few years, barely made back my contributions and then slowly the effect of cumulative interest takes off…

[url=https://flic.kr/p/zchho3]Pension growth[/url] by Ben Freeman, on Flickr

monkeycmonkeydoFree MemberPosted 8 years agoAs were in an official Bear market you could also invest in Newton Real Return or City financial absolute return fund.The latter doing very well even during the Chinese correction last August.

DobboFull MemberPosted 8 years agoI don’t get why Newton Real Return is so raved about, maybe it’s that its been around a while?

joeeggFree MemberPosted 8 years agoWell i’ve done it and committed some money.

Fundsmith

CF Woodford

Lindsell Train.

Obviously i’ve kept some money back for some new wheels !DobboFull MemberPosted 8 years agoGood choices joeegg. All Alpha managers with buckets loads of experience. I’ve also got some FGT also run by Nick Train.

Don’t go fiddling with them or checking them every day, just let them do there thing. Look long term and don’t fret about market fluctuations and press scaremongering, it’s all just noise 99% of the time. If the markets take a heavy hit use it as a buying opportunity not a signal to panic sell.

monkeycmonkeydoFree MemberPosted 8 years agoThey are good trusts,but I,m just a little concerned there may be some overlap in your investments.Did you check which companies they each invest in?I,ve made the same mistake with one or two of my holdings.

DobboFull MemberPosted 8 years agoThey don’t seem to have too much overlap in the top holdings maybe a couple of holdings, they are all large cap global funds (even though Woodfords benchmark is UK Equity Income). The managers all have there own styles, monkeycmonkeydo does make a good point and it’s a point to check.

Maybe go for a UK smaller co. or UK midcap next.

joeeggFree MemberPosted 8 years agoThese were unknown funds to me until i did a little research,and some tips from this thread. Speaking to the banks adviser yesterday he’d never heard of them as well !

trail_ratFree MemberPosted 8 years ago“Speaking to the banks adviser yesterday he’d never heard of them as well !”

does your banks adviser live in a chinese pipe ?probably the same advisers that run my companies pension scheme…..

The topic ‘50k to invest.Self invest or advise ?’ is closed to new replies.